Emanuel J. Friedman‘s EJF Capital is a fund that invests mainly in financial stocks. Seeing as the Federal Reserve increased interest rates last year and further hikes are expected in the near to medium term, it’s not surprising that many of EJF’s long bets have paid off pretty well. At Insider Monkey, we assess the performance of a fund’s publicly-disclosed equity portfolio by calculating the weighted average returns of its holdings in companies valued at over $1.0 billion. Even though we assume that these holdings are unchanged during a particular quarter and we don’t take into account other investments, we can still get an idea whether a fund is worth following.

In this way, EJF Capital, which had had an equity portfolio worth $1.06 billion at the end of June, generated a return of 15.56% in the third quarter from 45 positions that were ‘relevant’ to us. Among its top picks, were Zions Bancorporation (NASDAQ:ZION), Banner Corporation (NASDAQ:BANR), Citizens Financial Group Inc (NYSE:CFG), and Meridian Bancorp, Inc. (NASDAQ:EBSB). In this article, we’ll discuss how these companies performed last quarter and what hedge funds collectively think about them.

Inozemtsev Konstantin/Shutterstock.com

In Zions Bancorporation (NASDAQ:ZION), EJF Capital had increased its stake by 50% to 1.50 million shares worth $37.70 million during the second quarter. The investment was pretty profitable in the third quarter, as the stock returned 23.8%. At the end of the second quarter, a total of 40 of the hedge funds tracked by Insider Monkey were bullish on this stock, up by 21% over the quarter. The largest stake in Zions Bancorporation (NASDAQ:ZION) was held by Millennium Management, which reported holding $129.3 million worth of stock at the end of June. It was followed by Third Avenue Management with a $51.5 million position. Other investors bullish on the company included EJF Capital, Alyeska Investment Group, and Balyasny Asset Management.

Follow Zions Bancorporation National Association (NASDAQ:ZION)

Follow Zions Bancorporation National Association (NASDAQ:ZION)

Receive real-time insider trading and news alerts

Then there’s Banner Corporation (NASDAQ:BANR), which had a more modest performance last quarter, with the stock inching up by 3.4%. The fund had entered the quarter with a $33.72 million position containing 792,553 shares. Overall, 17 funds from our database were bullish on Banner Corporation at the end of June, up by 42% over the quarter. Among these funds, Oaktree Capital Management held the most valuable stake, which was worth $110.6 millions at the end of the second quarter and EJF Capital was on the second spot. Moreover, Forest Hill Capital, Basswood Capital, and Renaissance Technologies were also bullish on Banner Corporation (NASDAQ:BANR).

Follow Banner Corp (NASDAQ:BANR)

Follow Banner Corp (NASDAQ:BANR)

Receive real-time insider trading and news alerts

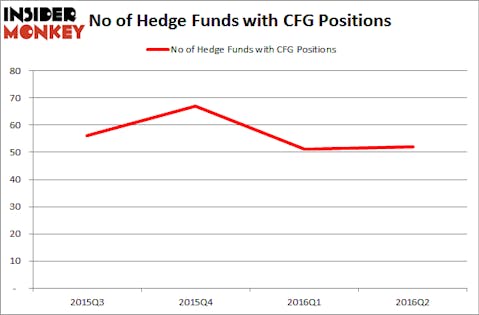

In Citizens Financial Group Inc (NYSE:CFG), EJF Capital had cut its stake by 25% on the quarter and held 1.50 million shares worth $29.97 million at the end of June. In the following three months, the fund saw the stock gain 24.3%. Heading into the third quarter of 2016, a total of 52 of the hedge funds tracked by Insider Monkey were long this stock, with the largest shareholder being AQR Capital Management, which reported holding $132.6 million worth of Citizens Financial Group Inc (NYSE:CFG)’s shares as of the end of June. It was followed by Lakewood Capital Management with a $130.4 million position. Other investors bullish on the company included Citadel Investment Group, Carlson Capital, and Kingstown Capital Management.

Follow Citizens Financial Group Inc (NYSE:CFG)

Follow Citizens Financial Group Inc (NYSE:CFG)

Receive real-time insider trading and news alerts

Finally, Meridian Bancorp, Inc. (NASDAQ:EBSB)‘s shares appreciated by 5.6% during the third quarter. At the end of June, EJF Capital held 2.0 million shares worth $29.56 million, being the largest shareholder among 14 funds from our database that were bullish on Meridian Bancorp, Inc. (NASDAQ:EBSB), up by 27% over the quarter. EJF was followed by Adage Capital Management with a $28.8 million position. Other investors bullish on the company included Renaissance Technologies, Hutchin Hill Capital, and Royce & Associates.

Follow Meridian Interstate Bancorp Inc (NASDAQ:EBSB)

Follow Meridian Interstate Bancorp Inc (NASDAQ:EBSB)

Receive real-time insider trading and news alerts

Disclosure: none