Hedge funds are not perfect. They have their bad picks just like everyone else. Valeant, a stock hedge funds have loved, lost 79% during the last 12 months ending in November 21. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 mid-cap stocks among the best performing hedge funds yielded an average return of 18% in the same time period, vs. a gain of 7.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Toro Co (NYSE:TTC).

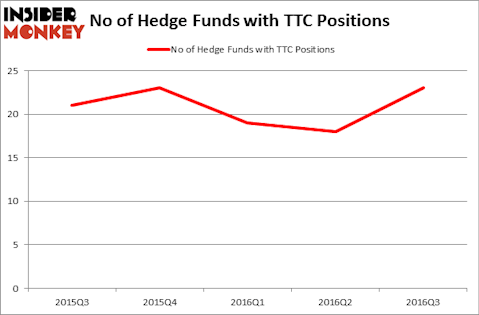

Toro Co (NYSE:TTC) shareholders have witnessed an increase in hedge fund interest of late, as a net total of 5 more hedge funds owned the stock at the close of September as did on June 30. At the end of this article we will also compare TTC to other stocks including AutoNation, Inc. (NYSE:AN), Acadia Healthcare Company Inc (NASDAQ:ACHC), and National Fuel Gas Co. (NYSE:NFG) to get a better sense of its popularity.

Follow Toro Co (NYSE:TTC)

Follow Toro Co (NYSE:TTC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

lassedesignen/Shutterstock.com

Hedge fund activity in Toro Co (NYSE:TTC)

At the end of the third quarter, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 28% jump from the previous quarter, pushing smart money ownership of the stock back to a yearly high. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ken Fisher’s Fisher Asset Management has the largest position in The Toro Company (NYSE:TTC), worth close to $85 million. Coming in second is Ian Simm of Impax Asset Management, with a $50.3 million position; the fund has 2.3% of its 13F portfolio invested in the stock. Remaining professional money managers that are bullish encompass Cliff Asness’ AQR Capital Management, Ric Dillon’s Diamond Hill Capital and John Overdeck and David Siegel’s Two Sigma Advisors.