World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

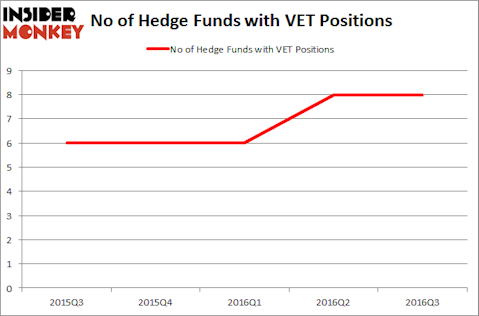

Vermilion Energy Inc (NYSE:VET) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 8 hedge funds’ portfolios at the end of September. At the end of this article we will also compare VET to other stocks including Lazard Ltd (NYSE:LAZ), Store Capital Corp (NYSE:STOR), and MSC Industrial Direct Co Inc (NYSE:MSM) to get a better sense of its popularity.

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

ded pixto/Shutterstock.com

With all of this in mind, we’re going to take a peek at the fresh action surrounding Vermilion Energy Inc (NYSE:VET).

How are hedge funds trading Vermilion Energy Inc (NYSE:VET)?

At the end of the third quarter, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 6 hedge funds with a bullish position in VET at the beginning of this year. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, D E Shaw, one of the biggest hedge funds in the world, has the number one position in Vermilion Energy Inc (NYSE:VET), worth close to $5.3 million, comprising less than 0.1%% of its total 13F portfolio. The second largest stake is held by Citadel Investment Group, led by Ken Griffin, which holds a $1.9 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other peers that hold long positions comprise Cliff Asness’s AQR Capital Management, Gregory Fraser, Rudolph Kluiber, and Timothy Krochuk’s GRT Capital Partners and Matthew Tewksbury’s Stevens Capital Management. We should note that GRT Capital Partners is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Judging by the fact that Vermilion Energy Inc (NYSE:VET) has weathered a decline in interest from the smart money, it’s safe to say that there is a sect of hedge funds who were dropping their positions entirely in the third quarter. At the top of the heap, Jim Simons’s Renaissance Technologies cut the biggest investment of the 700 funds studied by Insider Monkey, valued at an estimated $2.5 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund sold off about $1.4 million worth of shares.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Vermilion Energy Inc (NYSE:VET) but similarly valued. These stocks are Lazard Ltd (NYSE:LAZ), Store Capital Corp (NYSE:STOR), MSC Industrial Direct Co Inc (NYSE:MSM), and Hospitality Properties Trust (NYSE:HPT). This group of stocks’ market caps match VET’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LAZ | 14 | 420808 | -4 |

| STOR | 11 | 142506 | -6 |

| MSM | 21 | 555966 | -5 |

| HPT | 15 | 62406 | 3 |

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $295 million. That figure was $10 million in VET’s case. MSC Industrial Direct Co Inc (NYSE:MSM) is the most popular stock in this table. On the other hand Store Capital Corp (NYSE:STOR) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Vermilion Energy Inc (NYSE:VET) is even less popular than STOR. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Suggested Articles:

Smartphones With The Best Screen Resolution

Countries With The Cleanest Water In The World

Longest Hollywood Films

Disclosure: None