Before we spend many hours researching a company, we’d like to analyze what hedge funds and billionaire investors think of the stock first. We would like to do so because the elite investors’ consensus returns have been exceptional. The top 30 mid-cap stocks among the best performing hedge funds in our database yielded an average return of 18% during the last 12 months, outperforming the S&P 500 Index funds by double digits. Although the elite funds occasionally have their duds, such as SunEdison and Valeant, the hedge fund picks seem to work on average. In the following paragraphs, we find out what the billionaire investors and hedge funds think of General Growth Properties Inc (NYSE:GGP).

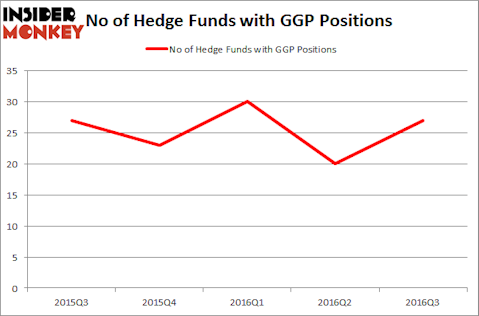

General Growth Properties Inc (NYSE:GGP) has seen an increase in support from the world’s most elite money managers recently, with seven more hedge funds long shares of the company on September 30 than there were 3 months earlier. At the end of this article we will also compare GGP to other stocks including The Allstate Corporation (NYSE:ALL), Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN), and O’Reilly Automotive Inc (NASDAQ:ORLY) to get a better sense of its popularity.

Follow Brookfield Property Reit Inc. (NASDAQ:BPYU)

Follow Brookfield Property Reit Inc. (NASDAQ:BPYU)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Alexander Raths/Shutterstock.com

How have hedgies been trading General Growth Properties Inc (NYSE:GGP)?

At Q3’s end, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 35% jump from the previous quarter, which followed a steep decline in Q2, as hedge fund ownership of GGP has been volatile. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Long Pond Capital, managed by John Khoury, holds the biggest position in General Growth Properties Inc (NYSE:GGP). Long Pond Capital has a $53.1 million position in the stock, comprising 2.5% of its 13F portfolio. The second most bullish fund manager is Millennium Management, led by Israel Englander, holding a $26.2 million position. Other professional money managers that are bullish encompass Jeffrey Furber’s AEW Capital Management, Phill Gross and Robert Atchinson’s Adage Capital Management and Dmitry Balyasny’s Balyasny Asset Management.