Before we spend many hours researching a company, we’d like to analyze what hedge funds and billionaire investors think of the stock first. We would like to do so because the elite investors’ consensus returns have been exceptional. The top 30 mid-cap stocks among the best performing hedge funds in our database yielded an average return of 18% during the last 12 months, outperforming the S&P 500 Index funds by double digits. Although the elite funds occasionally have their duds, such as SunEdison and Valeant, the hedge fund picks seem to work on average. In the following paragraphs, we find out what the billionaire investors and hedge funds think of General Growth Properties Inc (NYSE:GGP).

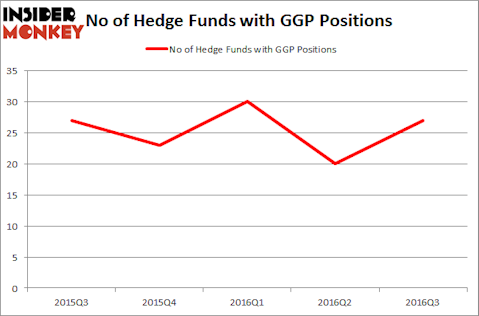

General Growth Properties Inc (NYSE:GGP) has seen an increase in support from the world’s most elite money managers recently, with seven more hedge funds long shares of the company on September 30 than there were 3 months earlier. At the end of this article we will also compare GGP to other stocks including The Allstate Corporation (NYSE:ALL), Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN), and O’Reilly Automotive Inc (NASDAQ:ORLY) to get a better sense of its popularity.

Follow Brookfield Property Reit Inc. (NASDAQ:BPYU)

Follow Brookfield Property Reit Inc. (NASDAQ:BPYU)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Alexander Raths/Shutterstock.com

How have hedgies been trading General Growth Properties Inc (NYSE:GGP)?

At Q3’s end, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 35% jump from the previous quarter, which followed a steep decline in Q2, as hedge fund ownership of GGP has been volatile. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Long Pond Capital, managed by John Khoury, holds the biggest position in General Growth Properties Inc (NYSE:GGP). Long Pond Capital has a $53.1 million position in the stock, comprising 2.5% of its 13F portfolio. The second most bullish fund manager is Millennium Management, led by Israel Englander, holding a $26.2 million position. Other professional money managers that are bullish encompass Jeffrey Furber’s AEW Capital Management, Phill Gross and Robert Atchinson’s Adage Capital Management and Dmitry Balyasny’s Balyasny Asset Management.

Consequently, key money managers have jumped into General Growth Properties Inc (NYSE:GGP) headfirst. Long Pond Capital established the most valuable position in General Growth Properties Inc (NYSE:GGP). John Overdeck and David Siegel’s Two Sigma Advisors also made a $20.7 million investment in the stock during the quarter. The other funds with brand new GGP positions are Jonathan Litt’s Land & Buildings Investment Management, George Hall’s Clinton Group, and Greg Poole’s Echo Street Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as General Growth Properties Inc (NYSE:GGP) but similarly valued. These stocks are The Allstate Corporation (NYSE:ALL), Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN), O’Reilly Automotive Inc (NASDAQ:ORLY), and Applied Materials, Inc. (NASDAQ:AMAT). All of these stocks’ market caps are similar to GGP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ALL | 27 | 1109142 | -2 |

| ALXN | 42 | 2107784 | -4 |

| ORLY | 42 | 1836056 | -2 |

| AMAT | 57 | 2527003 | 10 |

As you can see these stocks had an average of 42 hedge funds with bullish positions and the average amount invested in these stocks was $1.90 billion. That figure was $307 million in GGP’s case. Applied Materials, Inc. (NASDAQ:AMAT) is the most popular stock in this table. On the other hand The Allstate Corporation (NYSE:ALL) is the least popular one with only 27 bullish hedge fund positions. Compared to these stocks General Growth Properties Inc (NYSE:GGP) is only as popular as ALL. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted, especially given the surge in ownership of GGP in Q3.

Disclosure: None