Are Home Bancshares Inc (NASDAQ:HOMB), Calpine Corporation (NYSE:CPN), Pacira Pharmaceuticals Inc (NASDAQ:PCRX), and Rent-A-Center Inc (NASDAQ:RCII) stocks that should be part of your portfolio? According to our research, beating the market is possible by imitating the moves of smart money investors, and one fund that was bullish on all these four companies heading into the last quarter was Alex Lieblong‘s Key Colony Management.

The value of Key Colony Management’s equity portfolio jumped to $83.18 million from $78.49 million during the third quarter. The fund’s seven ‘relevant’ long positions brought a positive return of 15.05% in the third quarter. In our methodology, we include holdings in companies that had a market cap of at least $1 billion at the end of a particular quarter. Although these returns differ from the fund’s actual returns as they don’t include short positions and some other instruments, they still provide us with a guidance when it comes to assessing whether or not it is worth imitating the fund’s investment moves. Therefore, we are going to examine Key Colony Management’s positions in the aforementioned companies and see how did they perform in the third quarter.

bluebay/Shutterstock.com

Key Colony Management lowered its stake in Home Bancshares Inc (NASDAQ:HOMB) by 2%, twice, in second and third quarter, reporting a position of 1.12 million shares worth $23.41 million as of the end of September. During the third quarter, the stock appreciated by 5.6%. At the end of June, a total of 13 funds tracked by Insider Monkey were long this stock, an increase of 44% from the previous quarter. One of the biggest shareholders of Home Bancshares Inc (NASDAQ:HOMB) was Forest Hill Capital, which amassed a stake valued at $22 million at the end of June. Skylands Capital, Mendon Capital Advisors, and Cupps Capital Management also held valuable positions in the company.

Follow Home Bancshares Inc (NYSE:HOMB)

Follow Home Bancshares Inc (NYSE:HOMB)

Receive real-time insider trading and news alerts

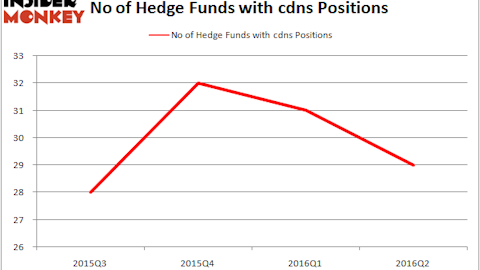

In power generation company, Calpine Corporation (NYSE:CPN), Key Colony Management had lowered its stake by 5% to 649,054 shares in the second quarter and closed the position entirely in the following three months as the stock slid by 14.3% in the same period. Heading into the third quarter of 2016, 32 from our database held long positions in this stock, down by 11% sequentially. Among these funds, Viking Global held the most valuable stake in Calpine Corporation (NYSE:CPN), which was worth $300.4 million at the end of the second quarter. On the second spot was Carlson Capital which amassed $183 million worth of shares. Moreover, Point State Capital, GoldenTree Asset Management, and Greenlight Capital were also bullish on Calpine Corporation (NYSE:CPN).

Follow Calpine Corp (NYSE:CPN)

Follow Calpine Corp (NYSE:CPN)

Receive real-time insider trading and news alerts

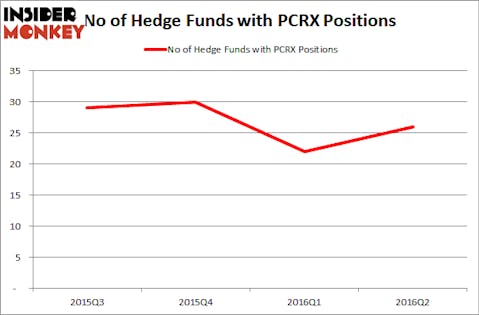

Next in line is Pacira Pharmaceuticals Inc (NASDAQ:PCRX), in which the fund cut its holding by 26% and 37% in the second and third quarter, respectively, disclosing a $4.76 million stake containing 139,000 shares as of the end of September. The stock inched up by 1.5% during the third quarter. During the second quarter the number of funds from our database long Pacira Pharmaceuticals went up by 18% to 26. More specifically, Daruma Asset Management was the largest shareholder of Pacira Pharmaceuticals Inc (NASDAQ:PCRX), with a stake worth $36.3 million reported as of the end of June. Trailing Daruma Asset Management was Millennium Management, which amassed a stake valued at $26.4 million. 40 North Management, Sarissa Capital Management, and Hoplite Capital Management also held valuable positions in the company.

Follow Pacira Biosciences Inc. (NASDAQ:PCRX)

Follow Pacira Biosciences Inc. (NASDAQ:PCRX)

Receive real-time insider trading and news alerts

Rent-A-Center Inc (NASDAQ:RCII) is another stock that the fund dumped in the third quarter, saying goodbye to a position that had contained 34,528 shares worth $424,000 at the end of June. The stock returned 3.6% during the third quarter, while over the past 12 months it has lost 29.45%. A total of 19 funds tracked by Insider Monkey were bullish on this stock at the end of June, down by 10% over the quarter. The largest stake in Rent-A-Center Inc (NASDAQ:RCII) was held by Pzena Investment Management, which reported holding $21.8 million worth of stock as of the end of the second quarter. It was followed by Royce & Associates with a $11.1 million position. Other investors bullish on the company included Elm Ridge Capital, Millennium Management, and D E Shaw.

Follow Upbound Group Inc. (NASDAQ:UPBD)

Follow Upbound Group Inc. (NASDAQ:UPBD)

Receive real-time insider trading and news alerts

Disclosure: None