Fool contributor John Reeves wrote about seven stocks in 2013 that Fool analysts recommended for investors. Out of those seven stocks, I pay special attention to four small and mid-cap businesses, including Tile Shop Hldgs, Inc. (NASDAQ:TTS), Western Refining, Inc. (NYSE:WNR), Arcos Dorados Holding Inc (NYSE:ARCO) and Lazard Ltd (NYSE:LAZ). I will take a closer look at each of these four stocks to determine whether or not investors should buy them at their current prices. In this article, I will focus on Tile Shop Holdings.

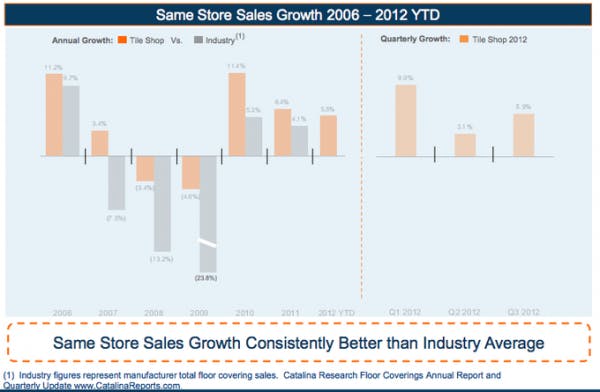

Tile Shop is a specialty retailer of natural stone tiles and maintenance materials with more than 4,000 products, including ceramic, porcelain, stainless steel, granite, etc. Tile Shop is operating 68 stores in 22 states and three distribution centers in the Midwest and mid-Atlantic US. Tile Shop sourced its products from more than 100 suppliers globally, including 10 suppliers from Asia, which accounted for around 55% of the total purchases. The majority of its net sales were generated from Stone products, accounting for 53% of total net sales. Ceramic products ranked second, representing 29% of the total revenue. In the company’s presentation, it was reported that Tile Shop’s same store sales growth has always been better than that of the industry. In 2011, it experienced 6.4% same store sales growth, while the average same store sales growth of the industry was only 4.1%.

Source: Tile Shop’s presentation

In the first nine months of 2012, Tile Shop had a 5.5% growth in its same store sales, higher than that of both Lowe’s Companies, Inc. (NYSE:LOW) and The Home Depot, Inc. (NYSE:HD). The comparable store sales growth of Lowe’s was only 1.2%, while Home Depot experienced a 3.9% rise in its same store sales. Indeed, as Tile Shop purchases its materials directly from a diverse base of global producers, it could provide shoppers with a much wider range of choices compared to Home Depot and Lowe’s. The retailer has also managed to grow its store count significantly. Since 2001, the number of stores has increased from 14 stores in 2001 to 68 stores today, marking an 11-year compounded annualized growth rate of 16%. In the next several years, Tile Shop is expected to double its store count to 130-140 stores.

High Margin, High Insider Ownership but Richly Valued

Over the last 4 years, Tile Shop has delivered much better adjusted EBITDA margins compared to Home Depot and Lowe’s. While Tile Shop had 28% EBITDA margin, the EBITDA margin of Home Depot and Lowe’s were 12.6% and 10.4%, respectively. Since 2007, Tile Shop has been consistently growing its profits, from $18.5 million in 2007 to $31.4 million in 2011. Over the past 12 months, its net sales reached $174 million and the adjusted EBITDA was $49 million, or 28%of adjusted EBITDA margin.