In 2005, Southwestern Bell (SBC) Communications acquired AT&T Inc. (NYSE:T) in a $16 billion transaction to “create the industry’s premier communications and networking company,” as described by AT&T. Shortly afterwards, SBC changed its name to AT&T. At that time, the AT&T management team was hungry for bulk through acquisition, investors were unhappy with the price paid for acquiring Cingular, and the Motley Fool recommended AT&T as a sell “until the company gets its arms around the new businesses.” It has been seven years since that recommendation. Has AT&T got its arms around the new businesses yet? Let’s see.

The AT&T Inc. (NYSE:T) of today is a multinational telecommunications corporation ranked in 2012 as the biggest telecommunications company in the United States, in relation to its revenue ($126 billion in 2012), and the 32nd largest company in the world, according to CNN. It is a leading IP-based communications service for businesses, has a large 4G network, and has over 30,000 AT&T Wi-Fi Hot Spots. As a result, AT&T is a common household name. In addition, AT&T is a component of the Dow Jones industrial average.

U-Verse

If that isn’t enough, AT&T has developed and is currently marketing its U-Verse TV. U-Verse TV is AT&T’s digital TV service that receives information via fiber optic technology. U-verse includes IPTV services, IP telephone and broadband Internet. Consequently, U-verse TV can support up to four active streams at the same time–an important aspect for many subscribers.

AT&T has been focusing a lot of its effort and money as of late on advertising U-Verse. This spending is paying off, as it has reported strong growth in U-Verse. More specifically, in 2011, U-Verse was available to over 30 million people in 22 states; at that time, it had 3.8 million subscribers. During the first quarter of 2013, AT&T Inc. (NYSE:T) had 8.7 million U-Verse subscribers. Hence, it more than doubled its subscriber numbers in less than two years. It strives to continue this trend.

While its U-Verse subscriptions are growing, these numbers are still distant from the 107 million wireless subscribers AT&T had in the first quarter of 2013. That being said, U-Verse and wireless are currently driving AT&T’s revenue.

Dividends

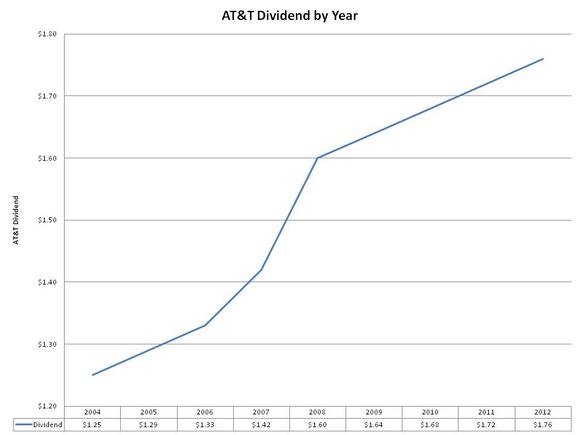

Alongside U-Verse, wireless and other AT&T telecommunication products, AT&T also has a great dividend. This dividend has increased every year since 2005, rising in that period from $1.29 to $1.76. Because of this dividend, DividendRank recently (June 11) put AT&T on its “S.A.F.E. 25” list, indicating that AT&T Inc. (NYSE:T) is a company with a strong 5% yield that has a (S) solid return, an (A) accelerating dividend amount over time, a (F) flawless history of not missing a dividend or lowering a dividend, and an (E) enduring quality, with a minimum of 20 years of dividend payments. In other words, the firm recommends AT&T as a safe investment with a strong dividend.

iPhone

In looking into AT&T’s dividend in more depth over the past decade, it can be seen that AT&T’s biggest dividend shift increase occurred after 2007. This was the same year it signed an exclusivity agreement with Apple Inc. (NASDAQ:AAPL) to be the carrier for its newly released iPhone. AT&T’s exclusivity agreement with Apple no longer exists, but Apple does currently have “non-exclusive” contracts with both AT&T and AT&T’s competitor, Verizon Communications Inc. (NYSE:VZ), the second-largest telecommunications company in the U.S. (revenue of $110 billion in 2012).