I’m sure you’ve heard the saying, “things are not always what they seem.” That’s what we have with RadioShack Corporation (NYSE:RSH). As a value investor, I’ve wanted to love this stock for a couple of years now; it’s constantly showing up on net-net screens, it’s in the news as a “dead” company, and rival Best Buy Co., Inc. (NYSE:BBY) has managed one of the great turnaround stories in retail.

The two, Best Buy Co., Inc. (NYSE:BBY) and RadioShack Corporation (NYSE:RSH), appeared to be in similar death spirals, and then 2013 came, transforming Best Buy into a new company.

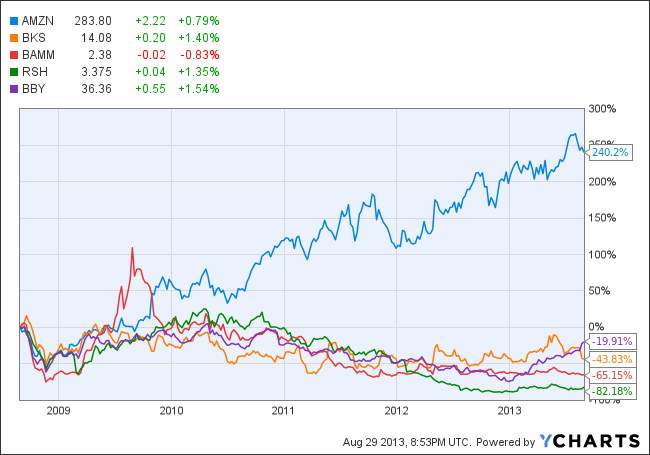

Source: YCharts

I am still a bit skeptical of the 200% run up in Best Buy Co., Inc. (NYSE:BBY)’s stock year to date. But the question remains, why can’t RadioShack Corporation (NYSE:RSH) do the same? All of this has led me to do some deep thinking as it relates to electronics, books, and e-commerce.

Amazon.com, Inc. (NASDAQ:AMZN) has forever changed the book industry. It’s doing the same with electronics. Amazon has soared, while the book and electronics retailers have suffered over the past decade.

Source: YCharts

First, Amazon.com, Inc. (NASDAQ:AMZN) started offering the ability to buy books for cheap online. Then came the ability to read books online and via tablets/e-readers. Now the book industry is struggling to survive. Borders went bankrupt back in 2011, and Books-A-Million has seen its EPS fall from $1.88 in 2005 to a $0.26 loss in fiscal 2013.

I can see the parallels in the electronics industry. Circuit City closed its doors back in 2008, and now RadioShack Corporation (NYSE:RSH) and Best Buy Co., Inc. (NYSE:BBY) are left to battle it out in the electronics-retail industry. RadioShack has seen a similar decline to Books-A-Million, with EPS dropping from $2.08 in 2004 to a loss of $2.06 over the trailing 12 months.

But back to why RadioShack Corporation (NYSE:RSH) can be deceiving. The stock trades around $4.00, but it has $4.33 in cash per share on the balance sheet. Its debt, however, is a tough pill for investors to swallow, with nearly $7.20 per share in debt.

On the other hand, Best Buy Co., Inc. (NYSE:BBY) may be able to continue muddling through, as it did manage to generate $2.5 billion in free cash flow during fiscal 2012. But RadioShack has negative free cash flow of $111 million and suspended its dividend payment back in 2012. And RadioShack’s debt-to-equity ratio is 140%, while Best Buy’s is 46%.

Smartphones

So Amazon.com, Inc. (NASDAQ:AMZN) is killing the Best Buy-RadioShack model by selling laptops and TVs, but there’s another problem on the horizon: smartphone saturation. Both Best Buy and RadioShack get around 50% of revenue from the smartphone market. ComScore believes that 60% of Americans already have a smartphone. And as UBS telecom analyst John Hodulik has famously said: “Everybody has got a smartphone.”

Yet, the likes of RadioShack and Best Buy are still focusing on smartphones, with Best Buy rolling out small mobile stores. A focus on low-margin smartphones should put further downward pressure on margins. Margins have been on the downhill slide, with Best Buy’s operating margin going from 5.4% in 2008 to 4.5% in 2010, and then 2.1% in fiscal 2012. The same is true for RadioShack; its operating margin went from 7.6% in 2008 to -2.7% over the trailing-12 months.