Generation Investment Management, managed by David Blood and Al Gore, recently filed its 13F with the U.S. Securities and Exchange Commission. For the second quarter of 2014 the hedge fund revealed 29 investments, worth $6.2 billion. Over the quarter, the fund added three positions and reduced holdings in more than 10 stocks. The fund mainly invested in Technology, Healthcare and Finance stocks. QUALCOMM, Inc. (NASDAQ:QCOM), Intuit Inc. (NASDAQ:INTU), and Microsoft Corporation (NASDAQ:MSFT) are represented as top three tech stock of the fund in the second quarter. In this article, we will talk about these three holdings.

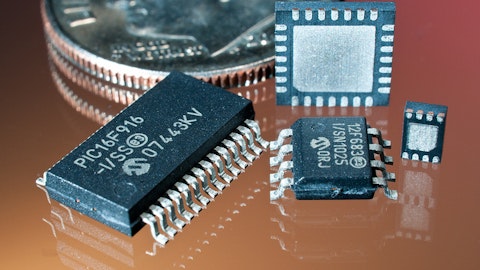

Generation Investment Management disclosed ownership of 7.59 million shares of QUALCOMM, Inc. (NASDAQ:QCOM). The value of the holding is $601.2 million, and the position represents a 1% decrease from the first quarter. QUALCOMM, Inc. (NASDAQ:QCOM) is a developer and innovator of advanced wireless technologies, products, and services, and has a market cap of $125.2 billion. Fisher Asset Management, led by Ken Fisher, reported owning 9.28 million shares of Qualcomm, and SPO Advisory Corp, led by John H. Scully, holds 6.37 million shares of the company.

In Intuit Inc. (NASDAQ:INTU) Generation Investment Management revealed holding 4.23 million shares, with a reported value of $340.3 million. The stake represents a 13% drop compared to 4.85 million shares the fund held at the end of first quarter. Having a market cap of $3.22 billion, Intuit Inc. (NASDAQ:INTU) engaged in providing business and financial management solutions for small businesses, consumers and accounting professionals. The company’s revenue for the fourth quarter of fiscal 2014 rose by 13% to $714 million, and its revenue for full year of fiscal 2014 jumped by 8% to $4.5 billion, according to a statement.

In addition, Intuit Inc. (NASDAQ:INTU) reported that it approved a dividend of up to $1.00 per share for fiscal 2015, representing a 32% increase from last year. The first quarterly dividend of $0.25 per share is payable on October 20, according to the company.

Ken Griffin’s Citadel Investment Group holds 2.54 million shares of Intuit Inc. (NASDAQ:INTU). Millennium Management, run by Israel Englander, is bullish on Intuit Inc. (NASDAQ:INTU), in which the fund boosted its stake more than 100% during the second quarter, owning 915,769 shares, according to our record.

Microsoft Corporation (NASDAQ:MSFT) is on the third spot in the list. It is a new position, where Generation Investment Management revealed ownership of 4.72 million shares, worth $196.8 million. Reportedly, Satya Nadella, CEO of Microsoft Corporation (NASDAQ:MSFT), will visit China sometime in September amid ongoing anti-trust investigation into the world largest software company. Microsoft Corporation (NASDAQ:MSFT) is one of at least 30 companies that has been investigated in China over that country’s six-year-old antitrust laws, which critics say are being used to unfairly target foreign businesses.

On September 1, Microsoft Corporation (NASDAQ:MSFT) Vice-President David Chen was questioned by The State Administration for Industry and Commerce regarding Microsoft Corporation (NASDAQ:MSFT)’s practices in the country, and given 20 days to respond. In particular, the presence of authentication codes in their software, used as an anti-piracy measure, seems to be a major sticking point with the Chinese regulators. China’s official Xinhua news service on Monday claimed that their inclusion “may have violated China’s anti-monopoly law”.

Disclosure: none