Jack Ripsteen‘s Potrero Capital Research is a California-based hedge fund, which has an equity portfolio worth around $109.77 million, as of the end of June. Potrero had a weighted average return of 20.05% in the third quarter, based on our calculations that include its 17 positions in companies having a market cap of $1 billion or more.

With the overall performance of hedge funds getting weaker, resulting in a massive investor exodus, it’s important to focus on funds that are still managing to beat the market. Even though our analysis involves only a part of a fund’s holdings and does not incorporate hedge funds’ short positions, or stakes in companies with market valuation less than $1 billion, we can still get an idea about the fund’s stock-picking skills.

There were 659 hedge funds in our system whose 13F portfolios on June 30 consisted of at least five long positions in billion-dollar companies. Of those 659 funds, an impressive 627 of them delivered positive returns during the third-quarter from their long positions in those stocks, based on the size of those positions on June 30. All told, their long picks in billion-dollar companies averaged 8.3% returns for the quarter, well above the S&P 500 ETFs’ 3.3% figure. Nonetheless, hedge funds continue to disappoint their investors for the most part, as redemptions have hit the industry hard of late. That can be chalked up to their high fees and the underperformance on the short-side of their portfolios, which provide downside protection but have dragged down overall returns. We recommend investors consider hedge funds’ long stock picks for their market-beating potential and will share four of them in this article, which were in the portfolio of Jack Ripsteen on June 30.

Out of 17 relevant positions held by Potrero Capital Research in companies valued at almost $1.10 billion on June 30, the fund’s holdings delivered weighted average returns of 20.05% during the third-quarter. It should be noted that our calculations may be different from the fund’s actual returns, as they do not factor in changes made to positions during the quarter, or positions that don’t get reported on Form 13Fs, like short positions.

In this article, we’ll take a look at four of the favorite stock picks of Potrero Capital Research and see how they performed during the third quarter.

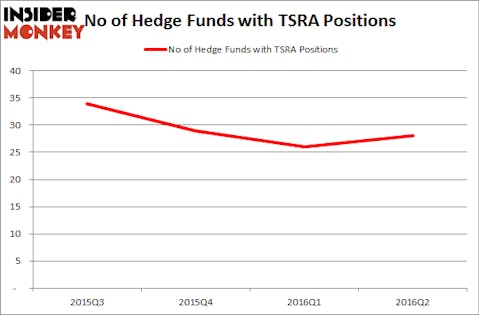

Potrero Capital Research reported ownership of 292,627 shares of California-based licensing and intellectual property company Tessera Technologies, Inc. (NASDAQ:TSRA), the stake being valued at $8.97 million. The stock returned 26.2% during the third quarter. Overall, 28 hedge funds out of nearly 750 funds tracked by Insider Monkey held stakes in Tessera Technologies, Inc. (NASDAQ:TSRA). The largest stake in Tessera Technologies, Inc. (NASDAQ:TSRA) was held by Renaissance Technologies, which reported holding $68.3 million worth of stock at the end of June. It was followed by Trigran Investments with a $39 million position. Other investors bullish on the company included D E Shaw, Royce & Associates, and Shannon River Fund Management.

Follow Tessera Technologies Inc

Follow Tessera Technologies Inc

Receive real-time insider trading and news alerts

Potrero held 185,499 shares of International Speedway Corp (ISCA) worth $6.21 million at the end of the second quarter and saw the stock inch down by 0.1% in the next three months. A total of 18 funds tracked by Insider Monkey were bullish on International Speedway Corp (NASDAQ:ISCA) at the end of June, down by 10% from the previous quarter. Among these funds, John W. Rogers’s Ariel Investments had the most valuable position in International Speedway Corporation (NASDAQ:ISCA), worth close to $131.2 million, comprising 1.6% of its total 13F portfolio. Sitting at the No. 2 spot was Jim Simons’ Renaissance Technologies holding a $13.1 million position. Other professional money managers that held long positions included Peter S. Park’s Park West Asset Management and D E Shaw.

Follow International Speedway Corp

Follow International Speedway Corp

Receive real-time insider trading and news alerts