Philip Morris International Inc. (NYSE:PM) owns the #1 cigarette brand in the world, Marlboro, along with other brands such as L&M, Fortune, Bond Street, Parliament, Red & White, and Virginia Slims. They also own a small cigar segment and have been growing its position in smokeless tobacco such as Swedish snus. Smoking cigarettes in the United States has become known as “disgusting,” or as being a bad habit, but internationally this is not the case.

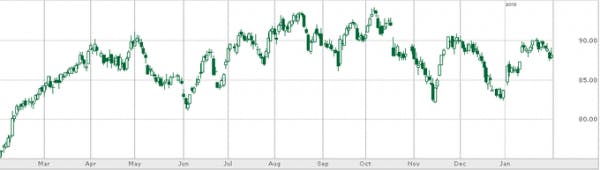

Philip Morris International is currently trading at $86.97 on Feb. 4, with earnings of $5.00 per share. At this price, it is trading at just 17.39 times earnings and 15.02 times 2013 projected earnings. These are great numbers, but what really sticks out is the company is projected to have earnings of $6.42 per share in 2014. This would make it currently trading at just 13.5 times those earnings. These multiples are much too low for the growth Philip Morris International has the potential to achieve in the next few years. Altria, Reynolds American, and Lorillard all have positive growth rates going forward, but not as high as this company.

My favorite statistic of Philip Morris International is that they pay out a terrific $3.40 dividend, representing a 3.91% yield. This dividend has been raised each of the last 4 years, including a recent 10%+ raise. Altria Group, the parent company, has raised its dividend for 47 consecutive years. There is no reason that Philip Morris International will not follow directly in their footsteps. Altria, Reynolds American, and Lorillard all currently have higher dividends, but with growth factored in, they do not rise to the top of the list. Altria currently yields 5.15%, Reynolds yields 5.38%, and Lorillard yields 5.2%. If you are looking for dividend income with smaller returns from overall gains, one of these may be your better bet.

With all of this said, Philip Morris International is incredibly cheap. The current industry average for price to earnings is 19.86, which would value this company around $99 per share. I project that the stock will return above $90 per share by the end of the first quarter and will surpass $104 in 2013 based on 18 times earnings. Even if the stock were to trade sideways for a while, the solid 3.86% dividend will pay to wait for the move higher. I am initiating an outperform on CAPS. Altria, Reynolds American, and Lorillard are all BUYS. Philip Morris International is a STRONG BUY.

The article A Smoking Hot International Opportunity originally appeared on Fool.com and is written by Joseph Solitro.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.