After Microsoft Corporation (NASDAQ:MSFT) inked a partnership with Nokia Corporation (ADR) (NYSE:NOK) in February 2011 many began to speculate that Microsoft would eventually acquire Nokia. On September 2 news broke that this had essentially taken place, with Microsoft paying about $7 billion for both Nokia’s devices and services business and a license to use the company’s trove of patents.

This is a big development for Microsoft Corporation (NASDAQ:MSFT), which is in the middle of a transition into a devices and services company. Microsoft launched its own tablets, the Surface and Surface RT, earlier this year, and with the acquisition of Nokia Corporation (ADR) (NYSE:NOK)’s phone business Microsoft is taking a huge step forward toward its goal.

What the acquisition means for Microsoft

Windows Phone has become the number three smartphone OS in the world, recently surpassing BlackBerry, and in certain regions they growing market share fast. In the UK market share more than doubled from 4.2% in 2012 to 9.2% today. In France market share has risen even faster, from 3.6% to 11%. In Latin America Windows Phone is now the second most popular mobile platform behind Android.

In the U.S., however, market share remains low. Rising from 3% last year to 3.5% today, Windows Phone has yet to make serious penetration into the domestic market.

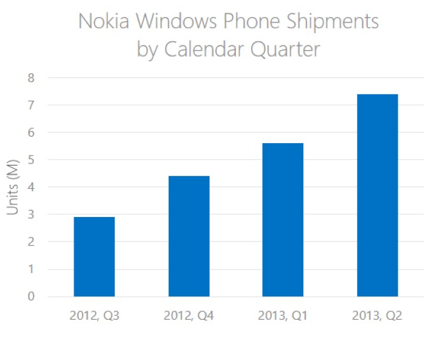

Nokia Corporation (ADR) (NYSE:NOK) makes up about 80% of the Windows Phone market, with other OEMs largely focused on Android. Nokia has been growing its quarterly phone shipments at a rapid pace, and in the most recent quarter Nokia shipped over 7 million Windows Phone devices.

Source: Microsoft Investor Presentation

Since Nokia Corporation (ADR) (NYSE:NOK)’s phone unit is currently unprofitable Microsoft Corporation (NASDAQ:MSFT) will absorb those losses. The company expects GAAP EPS to be reduced by $0.12 in the current fiscal year, but by fiscal 2016 growth combined with an expected $600 million in cost synergies should lead to the transaction being accretive to the EPS.

This is the sort of acquisition which is part of a long-term plan, and with the market more often focused on the short-term shares of Microsoft Corporation (NASDAQ:MSFT) fell by as much as much as 6% on the day following the announcement. Microsoft’s market capitalization was reduced by about twice the amount of cash Microsoft spent on Nokia Corporation (ADR) (NYSE:NOK), with the market apparently assigning a negative value to Nokia’s phone operations.

This deal will allow Microsoft Corporation (NASDAQ:MSFT) to react more quickly to the changing mobile market, with software, hardware, and marketing all under one roof. In the announcement slide show Microsoft lays out two long-term scenarios:

Source: Microsoft Investor Presentation

Compared to the size of Microsoft a few billion dollars per year in operating income means little, but compared to the price paid for Nokia it’s clear that if even the low-end scenario plays out Microsoft got a real bargain. It all comes down to execution on Microsoft’s part, and with a history of failed acquisitions there’s certainly no guarantee of success.

One of the most compelling positives regarding the acquisition is better unit economics. Under the previous partnership Microsoft was realizing a gross profit of less than $10 per unit. With the acquisition this number is expected to rise above $40 per unit, greatly increasing profitability per unit sold. Microsoft estimates that operating income will break even with costs when units exceed about 50 million annually, and with a current annual run-rate of nearly 30 million this point could be only 1-2 years away.

Microsoft needs as many Windows devices in peoples’ hands as possible, and the Nokia deal is a step forward for the company. If Microsoft can continue to grow unit volume and take market share then Windows Phone will eventually become the number two phone OS worldwide.