Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth depends on it. Regardless of the various methods used by successful investors like David Tepper and Dan Loeb, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

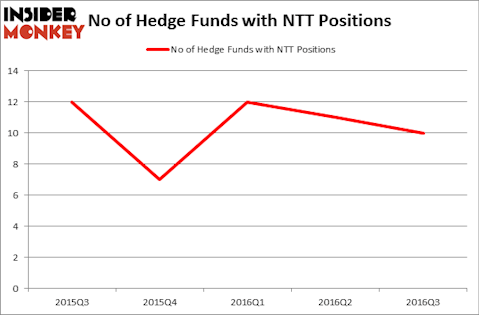

Nippon Telegraph & Telephone Corp (ADR) (NYSE:NTT) was in 10 hedge funds’ portfolios at the end of September. NTT investors should pay attention to a decrease in enthusiasm from smart money lately. There were 11 hedge funds in our database with NTT holdings at the end of the previous quarter. At the end of this article we will also compare NTT to other stocks including BHP Billiton Limited (ADR) (NYSE:BHP), Royal Bank of Canada (USA) (NYSE:RY), and Allergan, Inc. (NYSE:AGN) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

SpeedKingz/Shutterstock.com

With all of this in mind, let’s take a glance at the key action regarding Nippon Telegraph & Telephone Corp (ADR) (NYSE:NTT).

Hedge fund activity in Nippon Telegraph & Telephone Corp (ADR) (NYSE:NTT)

At the end of the third quarter, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, down 9% from one quarter earlier. On the other hand, there were a total of 7 hedge funds with a bullish position in NTT at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Renaissance Technologies, one of the largest hedge funds in the world, holds the biggest position in Nippon Telegraph & Telephone Corp (ADR) (NYSE:NTT). According to regulatory filings, the fund has an $88.5 million position in the stock. Coming in second is Peter Rathjens, Bruce Clarke and John Campbell of Arrowstreet Capital holding a $77.1 million position. Other professional money managers with similar optimism contain Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners, Israel Englander’s Millennium Management and Thomas Bailard’s Bailard Inc. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.