If investors had a magic mirror that could give them the answer to the question “which stock is the perfect stock?”, then investing would have been a piece of cake. But, in the Wall Street world it does not work like that. It takes time and effort to find a stock that is worth your money.

In my quest for a compelling investment opportunity, I stumbled upon Skyworks Solutions Inc (NASDAQ:SWKS), a mid-sized innovator of high performance analog and mixed signals semiconductors, and, according to the Motley Fool, one of America’s best companies.

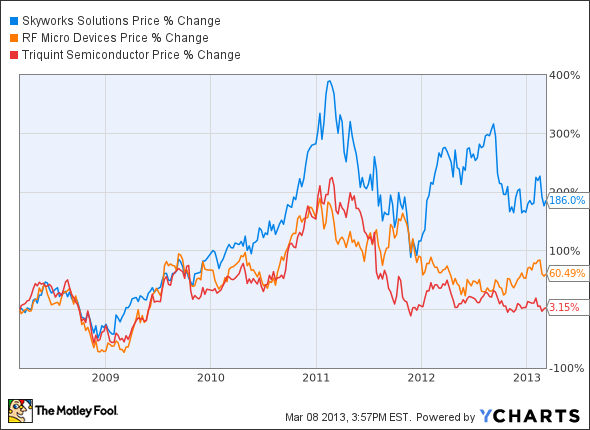

In order to decide whether it rightly deserves a spot in my portfolio, I thought I’d check how the company performs based on a few key factors. To spice it up a bit, I did the same for two of its direct competitors, RF Micro Devices, Inc. (NASDAQ:RFMD), and TriQuint Semiconductor (NASDAQ:TQNT).

Key factors

1.Top-line growth: For a business, revenue is the fuel that keeps the engine running. Without sturdy sales performance growing the bottom line would be nothing more than wishful thinking.

2. Financial condition: The balance sheet gives you a glimpse of a company’s financial condition. A current ratio of above 2 means that it can pay its bills and has some extra cash left to make new investments; a debt-to-equity ratio lower than 1 means that the business is positively geared, and shareholders do not have to worry about the destructive implications of debt.

3. Margins: Margins reflect a company’s ability to generate profits. Its product and service portfolio might be a real money-spinner, but if it cannot convert sales into profits, then what’s the point?

4. Management effectiveness: Return on equity tests how effectively a company balances profitability, asset management, and financial leverage. In other words, it gauges management’s ability to enhance the company’s value using investment funds.

5.Valuation: Nobody wants to pay through the nose even for the best companies. Stocks with valuation metrics that could indicate a possible value opportunity hold a special place in investors’ hearts.

Results

Source: Finviz and Ycharts

Compared to the other two, Skyworks Solutions Inc (NASDAQ:SWKS) seems to win all the marbles. It failed to reach the net profit margin and ROE benchmark by a hairbreadth, but, overall, it is a stock worth owning. Skyworks’s rich and, at the same time, diversified customer base, which includes clients like Google Inc (NASDAQ:GOOG), Apple Inc. (NASDAQ:AAPL), and Cisco Systems, Inc. (NASDAQ:CSCO), indicates a relatively stable revenue stream. Its clean as a whistle balance sheet provides it with flexibility in addressing any kind of market turbulence without sacrificing shareholders’ value.

Over the past five years, longtime Skyworks Solutions Inc (NASDAQ:SWKS) investors have been rewarded with hefty returns as shown in the chart below:

TriQuint Semiconductor(NASDAQ:TQNT) comes in dead last. In the most recent quarter, the radio frequency solutions supplier, beat analysts expectations both on the top and bottom-line front. However, its future looks clouded as it expects a rather gloomy first quarter ahead. TriQuint’s remarkable cash position is not enough to give it an edge over its peers.