If investors had a magic mirror that could give them the answer to the question “which stock is the perfect stock?”, then investing would have been a piece of cake. But, in the Wall Street world it does not work like that. It takes time and effort to find a stock that is worth your money.

In my quest for a compelling investment opportunity, I stumbled upon Skyworks Solutions Inc (NASDAQ:SWKS), a mid-sized innovator of high performance analog and mixed signals semiconductors, and, according to the Motley Fool, one of America’s best companies.

In order to decide whether it rightly deserves a spot in my portfolio, I thought I’d check how the company performs based on a few key factors. To spice it up a bit, I did the same for two of its direct competitors, RF Micro Devices, Inc. (NASDAQ:RFMD), and TriQuint Semiconductor (NASDAQ:TQNT).

Key factors

1.Top-line growth: For a business, revenue is the fuel that keeps the engine running. Without sturdy sales performance growing the bottom line would be nothing more than wishful thinking.

2. Financial condition: The balance sheet gives you a glimpse of a company’s financial condition. A current ratio of above 2 means that it can pay its bills and has some extra cash left to make new investments; a debt-to-equity ratio lower than 1 means that the business is positively geared, and shareholders do not have to worry about the destructive implications of debt.

3. Margins: Margins reflect a company’s ability to generate profits. Its product and service portfolio might be a real money-spinner, but if it cannot convert sales into profits, then what’s the point?

4. Management effectiveness: Return on equity tests how effectively a company balances profitability, asset management, and financial leverage. In other words, it gauges management’s ability to enhance the company’s value using investment funds.

5.Valuation: Nobody wants to pay through the nose even for the best companies. Stocks with valuation metrics that could indicate a possible value opportunity hold a special place in investors’ hearts.

Results

Source: Finviz and Ycharts

Compared to the other two, Skyworks Solutions Inc (NASDAQ:SWKS) seems to win all the marbles. It failed to reach the net profit margin and ROE benchmark by a hairbreadth, but, overall, it is a stock worth owning. Skyworks’s rich and, at the same time, diversified customer base, which includes clients like Google Inc (NASDAQ:GOOG), Apple Inc. (NASDAQ:AAPL), and Cisco Systems, Inc. (NASDAQ:CSCO), indicates a relatively stable revenue stream. Its clean as a whistle balance sheet provides it with flexibility in addressing any kind of market turbulence without sacrificing shareholders’ value.

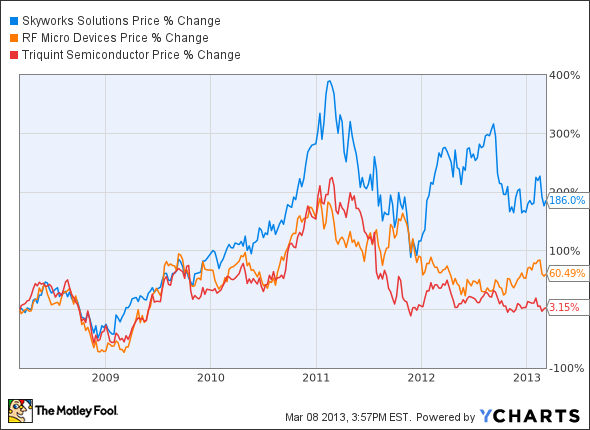

Over the past five years, longtime Skyworks Solutions Inc (NASDAQ:SWKS) investors have been rewarded with hefty returns as shown in the chart below:

TriQuint Semiconductor(NASDAQ:TQNT) comes in dead last. In the most recent quarter, the radio frequency solutions supplier, beat analysts expectations both on the top and bottom-line front. However, its future looks clouded as it expects a rather gloomy first quarter ahead. TriQuint’s remarkable cash position is not enough to give it an edge over its peers.

RF Micro Devices, Inc. (NASDAQ:RFMD), a major player in radio frequency power management, recently expanded its portfolio of multimode multi-band power amplifiers. The company anticipates significant gains from this recent portfolio deployment aiming to leverage its leadership in the space. Nevertheless, fundamentally, RF Micro Devices is in a not so good shape. Low margins and a revenue roller coaster do not translate into a lucrative investment opportunity.

For the last three months of 2012, the company experienced strong top-line performance supported by solid demand for its cellular products group (CPG), and multi-market products group (MPG) segments. But, for the quarter ahead, revenue is estimated to decrease by approximately 6-8% sequentially.

Risks

QUALCOMM, Inc. (NASDAQ:QCOM) rocked the wireless technology boat when it unveiled plans to introduce its own radio frequency chip. Qualcomm’s new chipset, which supports seven cellular radio technologies, pretty much makes the current frequency components obsolete.

Evidently, competition is heating up in an already overcrowded market. Nonetheless, analysts seem to believe that Skyworks is perfectly capable of surviving a possible onslaught from Qualcomm. Out of twenty analysts tracked by Wall Street Journal, fourteen urge investors to buy the stock while two indicate an “outperform” rating.

Bottom line

Some may think that the perfect stock is hard to come by, if not impossible. After all, perfection is by definition, a state of the impossible. However, the more you seek for an investment utopia, the closer you get to it.

Skyworks might not be by all means the perfect stock, but it has certain qualities that underlie a huge opportunity. With comparably favorable attractive valuations and 5-year expected EPS growth greater than 15%, I cannot find a reason not to consider initiating a position in this stock.

The article Mirror Mirror on the Wall, Is Skyworks the Perfect Stock? originally appeared on Fool.com and is written by Fani Kelesidou.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.