On Feb. 19, Michael Kors Holdings Ltd (NYSE:KORS) announced plans for certain selling shareholders to sell up to 28.75 million shares in a secondary offering. The company confirmed the next day the pricing of the offering at $61.50. Should investors stick with a stock if insiders are unloading?

As an investor do you really want to own a stock where the insiders are fleeing the stock after a substantial run? One has to consider whether the stock is fully priced at these levels.

Selling shareholders are unloading 25 million shares in a secondary offering with the underwriters granted a 30-day option to purchase an additional 3.75 million shares. The secondary priced at $61.50 on Feb. 20 with an expected closing on Feb. 26.

The company, a global luxury lifestyle brand with a multi-channel strategy, announced the offering after the market closed on Feb. 19 when the stock closed at $64.84. It has since dropped to around $59 due to market conditions and primarily the investor concerns over large shareholders cashing out around a potential top.

Major Insiders Selling

Considering the company isn’t selling any shares, the concerns with investors are the size and willingness of insiders to cash out. The company has 200.6 million shares outstanding meaning that this offering entails 14.3% of the outstanding shares being added to the public float. More importantly, the value is over $1.5 billion, which is an abnormally high amount for the markets to absorb. The size places the offering as one of the largest in the last few years, exceeding all but a few initial offerings such as Facebook Inc (NASDAQ:FB).

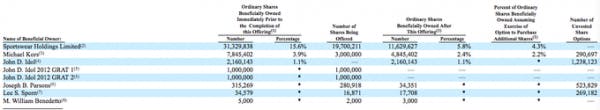

The main sellers are Sportswear Holdings Limited, Michael Kors, and John D. Idol. Sportswear is selling an incredible 19.7 million shares prior to the over-allotment amount and could reduce the ownership stake to 4.3% from 15.6%. Even more importantly is the decision by CCO and namesake, Michael Kors, to unload at least 3 million shares and potentially reduce his stake from only 3.9% to as low as 2.2%. See table below for more details:

Writing on the Handbag

The recent trading action of Coach, Inc. (NYSE:COH) might be the cause of the large insiders jumping ship. Prior to the secondary announcement, Kors had reached a valuation comparative to that of Coach now. Sure that stock has plunged from nearly $80 to the current price of below $47, but the sellers might realize how fleeting this current valuation could become. Kors still needs to double to reach the revenue base of Coach.

Still as an insider, it would seem that reaching a valuation of where Coach peaked out at over $20 billion would be a likely and attainable goal if the company keeps on the existing path. Ralph Lauren Corp (NYSE:RL) is worth over $15 billion, providing another example of where the stock could reach in the future.