Known as the “eBay Inc (NASDAQ:EBAY) of Latin America,” online auction site Mercadolibre Inc (NASDAQ:MELI) is often hailed as one of the great emerging market stocks – and for good reason. The company enjoys a majority e-commerce market share in nearly every developed country in Latin America – a fertile ground for online retail thanks to rising Internet penetration, increased credit card usage, and a growing middle class. So what makes MercadoLibre tick? Will the company continue to grow, or will concerns about declining GDP and rising inflation hurt the company’s growth prospects?

The Foolish Fundamentals

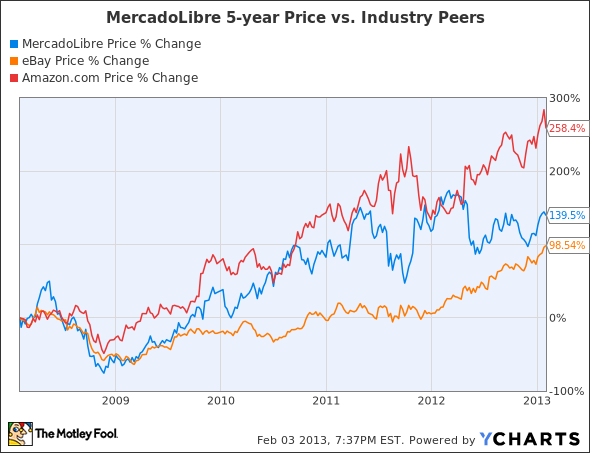

MercadoLibre caught my eye during a recent search for momentum growth stocks. I wanted to find stocks that had demonstrated strong past performance through high ROI and ROE, as well as powerful momentum based on high expectations, using higher than average P/E ratios.

Here are the minimum criteria I initially set.

1). Market Cap: 1 Billion

2). P/E Ratio: 40

3). Gross Margin: 25%

4). 5-year Revenue Growth Rate: 25%

5). 5-year EPS Growth Rate: 25%

6). 5-year Return on Equity: 25%

7). 5-year Return on Investment: 25%

Only three stocks in the entire U.S. market fit all seven criteria: Lululemon Athletica inc. (NASDAQ:LULU), Mercadolibre Inc (NASDAQ:MELI) and SolarWinds Inc (NYSE:SWI). MercadoLibre interested me the most, as it would complement my previous article regarding Amazon.com, Inc. (NASDAQ:AMZN)’s growth initiatives in Brazil. So how does MercadoLibre stack up in those seven categories?

Market Cap | P/E (ttm) | Operating Margin % (ttm) | 5 yr. Revenue Growth | 5 yr. EPS Growth | 5 yr. Return on Equity: | 5 yr. Return on Investment |

$3.86B | 41.78 | 33.54% | 265.4% | 670.4% | 39.28 | 37.02 |

Source: Yahoo Finance (data as of 2/3/2013)

That impressive top and bottom line growth shows that Latin America e-commerce is a force to be reckoned with.

The Latin eBay

MercadoLibre (“free market”) is eBay’s Latin American partner, and is currently the region’s number one e-commerce site. It has a sprawling presence across 13 Latin American countries. Its website operates in the same way as eBay – buyers bid on desired items within a limited amount of time to win auctions. MercadoLibre also offers a “fixed price” system – used by 80% of sellers – similar to eBay’s “Buy it Now” option.

Buyers then use MercadoPago (which is similar to eBay’s PayPal system), credit cards or money orders to pay. Based on eBay’s incredible success with PayPal, MercadoPago could evolve into a challenger to Visa Inc (NYSE:V) or Mastercard Inc (NYSE:MA), as the market for mobile cashless payments increases.

MercadoLibre became a regional monopoly in 2005, after acquiring primary rival DeRemate’s operations in Brazil, Colombia, Ecuador, Mexico, Peru, Puerto Rico and Venezuela. This move consolidated MercadoLibre’s rule in Latin America, and it has been unchallenged since.

Micro Factors

Due to the international, cross-border nature of its e-commerce business, conflicts have risen when regulated products, such as pharmaceuticals, were shipped by MercadoLibre merchants to other countries without appropriate permits.

Illegal transactions and fraud have also been problematic to the company, but nearly impossible to police due to the size of its operations. MercadoLibre employs a “buyer beware” policy on its site, but it is not legally enforced.

Latin American culture also encourages payments by installments, even for purchases as small as toilet paper. Critics claim that this practice encourages debt and makes e-commerce revenue flow unstable and unpredictable.

Macro Factors

Let’s compare population and Internet penetration across the Americas.

Source: http://www.internetworldstats.com

Notice that Central and South America – MercadoLibre’s primary markets – distantly trail North America in Internet penetration. That means Internet-related businesses, such as search and e-commerce, will flourish in the next decade if consumer spending increases accordingly.

So will Latin America’s GDP grow in tandem with its Internet usage? The following chart compares the GDP growth of the five largest South American economies, along with Mexico, which together form the core of the Latin American economy.

Source: http://data.worldbank.org/

Although the hottest days of Latin American growth are behind it, all six countries have posted a slow but certain recovery from the nadir of the financial crisis in 2009.

However, all of the countries except Colombia and Peru have declined since 2010. Brazil, the largest Latin American economy, posted the sharpest decline, and preliminary forecasts for its 2012 GDP growth see a continuation of the downtrend, down to 1.03% growth.

Yet GDP growth can be deceptive – Brazil’s online retail sales actually grew 20% between 2010 and 2011 as GDP declined. In the first half of 2012, e-commerce sales grew by 21%. Here are the past and projected figures of Latin American e-commerce growth, between 2010 and 2016.

Source: http://www.newmediatrendwatch.com

This means that although GDP growth isn’t as hot as it used to be, it isn’t a reliable indicator of e-commerce growth. Growing credit card penetration rates and mobile growth will also boost e-commerce, especially in younger markets such as Argentina. The popularity of MercadoLibre’s Android App strongly suggests healthy mobile growth prospects.

However, inflation in several key areas of Latin America could hurt MercadoLibre, since the company collects revenue in ten different currencies but only reports earnings in U.S. dollars. That’s a lot of unpredictable foreign currency impacts on its bottom line.

The Foolish Takeaway

MercadoLibre is so well positioned to capitalize on Latin American growth that any macro movements in the region are equivalent to micro ones. Investors should pay attention to the key metrics of Latin American growth – GDP, Internet penetration and e-commerce growth – to gauge MercadoLibre’s future performance.

While MercadoLibre is considered a bellwether of its industry, investors should also keep a close eye on Amazon. Amazon’s recent push into Brazil – MercadoLibre’s weakest market with a 20% share – shows that it’s ready to play rough and expand its brand into Latin America. These baby steps, especially assisted by the recent launch of the Kindle Fire in South America, could disrupt a market that MercadoLibre has so easily dominated over the past decade.

The article Spice Up Your Portfolio With the Latin eBay originally appeared on Fool.com and is written by Leo Sun.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.