McDonald’s Corporation (NYSE:MCD) saw a near 3.5% pullback earlier this year after less-than-stellar earnings, but I’m thinking this pullback is a great opportunity to jump into the stock.

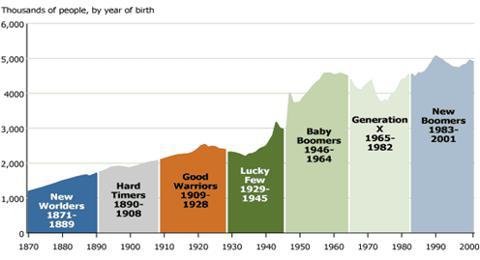

The fast-food giant posted 2Q EPS of $1.38, missing consensus of $1.40, but same-store sales were up 1%. One of the real worries for McDonald’s Corporation (NYSE:MCD) is that it’s losing its appeal to Gen-Y. This generation is moving toward a focus on healthy and fresh eating. And what makes Gen-Y so powerful is that it’s the largest generation we’ve seen thus far.

This group will have the power to change a number of industries, meaning McDonald’s Corporation (NYSE:MCD) will need to address the changing taste presences. Thus, the restaurant is offering a variety of more health-focused products, including McWrap and salads, but these remain a small part of sales.

McDonald’s Corporation (NYSE:MCD) has one of the most recognized brands anywhere, being the largest fast-food chain in the world. However, and this is interesting, the company owns less than 10% of the global informal restaurant market share.

One of its biggest initiatives is in the overseas market. The company plans to spend some $3.2 billion to open 1,600 new restaurants in the near term, with a focus on emerging markets. Specifically, the company hopes to have over 2,000 restaurants in China by the end of 2013. Breakfast is a big opportunity for the Asian market, where the percentage of the population eating breakfast is less than half that in the U.S.

McDonald’s is also a believer in returning capital to shareholders. Over the last five years, it returned some $27 billion to its shareholders via dividends and buybacks. The fast-food company has upped its dividend every year since 1976.

Best comp isn’t the best

Although its doesn’t compete with McDonald’s Corporation (NYSE:MCD) on the burger front, Yum! Brands, Inc. (NYSE:YUM) competes on a similar international scale. The biggest news for Yum! Brands, Inc. (NYSE:YUM) over the past year includes the incident in China where its chicken was overloaded with chemicals. However, as I’ve said before,

This recent event might be unveiling a bigger issue: brand erosion in China. Not only this, there are other regulatory issues related to operating in China. The slowing Chinese economy will also put pressure on the company, all of which have compelled management to offer guidance of a low- to mid-single digit earnings per share decline in 2013, as opposed to its long-term target of at least 10% earnings growth.

Revenue is expected to be flat in 2013, and restaurant margins down 130 basis points to 15.4% due to weak same-store sales in China. Earlier this month Yum! Brands, Inc. (NYSE:YUM) posted fiscal 2Q EPS of $0.56, compared to $0.67 for the same quarter last year, on the back of an 8% revenue drop. Also worth noting is that same-store sales were down 20% in China.

Despite these concerns, Yum! Brands, Inc. (NYSE:YUM) really is a chicken, pizza and Mexican monster. Its KFC brand owns 38% of the fast-food chicken market in the U.S., according to NPD Group. Going into 2013, there were 4,600 KFCs in the U.S. and 4,260 in China. However, worth noting is that only 5% of U.S. units are company-owned, compared to 80% in China, hence the reason that Yum! Brands, Inc. (NYSE:YUM) gets the majority of its revenue from China.

The company also operates the largest pizza chain, Pizza Hut, which owns 16% of the U.S. market share. Its Taco Bell chain is the largest U.S. fast-food Mexican chain, with about a 49% market share.

Even still, the key headwinds for the company include a slowing of the Chinese economy and continued worries for its chicken products, and increasing pressure for Pizza Hut.

Casual fast

The likes of various casual-fast restaurants have been taking market share form the likes of the fast-food stores. One such restaurant is Panera Bread Co (NASDAQ:PNRA). The company owns/franchises 1,650 restaurants.