Wall Street brokers and hedge fund managers are generally known to underperform the market. Most financial professionals in charge of other people’s money take more risk than they should so that they can earn a larger dollar amount–after all, the excitement of big returns still brings in new as well as old investors. Let us focus on the “boring” or “unsexy” way of making large returns that do not require any “professionals” to pick our pockets. The financial crisis was a disastrous time for stocks in general, as panic selling caused most stocks to be cut in half or more. Investors who had the confidence to buy more or to just hold onto their positions have been rewarded handsomely.

Dividend growth investments for the retail investor

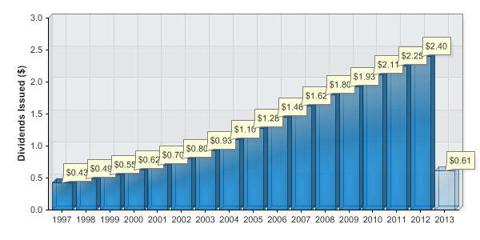

McDonald’s Corporation (NYSE:MCD) Dividend Hike History

| Feb 27, 2013 | 0.77 Dividend |

| Nov 29, 2012 | 0.77 Dividend |

| Aug 30, 2012 | 0.70 Dividend |

| May 31, 2012 | 0.70 Dividend |

| Feb 28, 2012 | 0.70 Dividend |

| Nov 29, 2011 | 0.70 Dividend |

| Aug 30, 2011 | 0.61 Dividend |

| May 27, 2011 | 0.61 Dividend |

| Feb 25, 2011 | 0.61 Dividend |

| Nov 29, 2010 | 0.61 Dividend |

| Aug 30, 2010 | 0.55 Dividend |

| May 27, 2010 | 0.55 Dividend |

| Feb 25, 2010 | 0.55 Dividend |

| Nov 27, 2009 | 0.55 Dividend |

| Aug 28, 2009 | 0.50 Dividend |

| Jun 4, 2009 | 0.50 Dividend |

| Feb 26, 2009 | 0.50 Dividend |

| Nov 26, 2008 | 0.50 Dividend |

| Aug 28, 2008 | 0.375 Dividend |

| Jun 5, 2008 | 0.375 Dividend |

| Feb 28, 2008 | 0.375 Dividend |

| Nov 13, 2007 | 1.50 Dividend |

| Nov 13, 2006 | 1.00 Dividend |

| Nov 10, 2005 | 0.67 Dividend |

| Nov 10, 2004 | 0.55 Dividend |

| Nov 12, 2003 | 0.40 Dividend |

| Nov 13, 2002 | 0.235 Dividend |

| Nov 13, 2001 | 0.225 Dividend |

| Nov 13, 2000 | 0.215 Dividend |

| * Close price adjusted for dividends and splits. | |

As the table above illustrates, over the past decade McDonald’s Corporation (NYSE:MCD) has managed to increase its dividend by 27.4 percent annually. The rate that annual dividends were raised ranged from a low of 4.4 percent in 2002 to a high of 70.2 percent in 2003. Between 2000 and 2002, McDonald’s Corporation (NYSE:MCD) distributions increased by less than 5 percent annually. The 70.2 percent dividend increase in 2003 started a new pattern of strong dividend growth. The company increased dividends for 35 years consecutively, and currently yields 3.1 percent. McDonald’s Corporation (NYSE:MCD) has low payout ratio of under 60 percent and has a projection of more than 7 percent growth in earnings per share. Its free cash flow in the future indicates that the company will be able to continue increasing its dividend.

McDonald’s Corporation (NYSE:MCD) weathered the financial crisis very well compared to the overall market, as its stock price dropped just over 20 percent from its 2008 high of $65.67 to its 2009 low of $52.12. This drop provided a great opportunity for dividend growth investors who continued to buy shares. These investors who bought shares in the $50 dollar range currently have dividend yields of over 5 percent, as well as a capital appreciation of nearly 100 percent.

Johnson & Johnson (NYSE:JNJ) is another company that has been increasing dividends consistently for decades. Young investors will benefit the most from starting to accumulate shares of JNJ now until retirement. This supplier of consumer products such as band aids, skin care, hair care, and Tylenol, has increased its payout by a compounded annual rate of 14.2 percent since 1970.

Johnson and Johnson’s dividend has gone up during market crashes as well as good times. The increases are highly likely to continue, based on future earnings projections and its free cash flow growth of over 7 percent per year. Its modest payout ratio is approximately 62 percent, which gives investors insight into the high likelihood of future dividend hikes.

Johnson and Johnson went from a high of $71.55 to a March 2009 low of $47.97, or a 32.9 percent drop in price. Investors who were able to muster up the courage to buy more near these lows were able to capture over a 5 percent dividend from this strong dividend provider. It is extremely likely that a young investor who has a 40-year time horizon will see their original investment become their annual dividend. Investors who were able to capture these accidental high yielders are in terrific shape, as companies such as Johson & Jonhson and McDonald’s Corporation (NYSE:MCD) continue to increase dividends for shareholders.

Johnson & Johnson (NYSE:JNJ) Dividend Hike History

Investors must have a different mindset when buying dividend growth stocks. The capital appreciation is not the main focus when buying these companies, as it often is on Wall Street. Dividend growth investors should be ecstatic when the market provides pullbacks and opportunities for new entry points–it just means they can buy more shares for cheap.

Finding multi-baggers is a rarity, and searching for them poses a great deal of risk when investors are aspiring to hit home runs all the time. Stick to a dividend reinvestment plan that includes strong, fundamentally sound companies like the ones highlighted above. This will give you a peace of mind, as well as enormous financial freedom.

The article The Simplicity Of Investing: What Wall Street Does Not Want You To Know originally appeared on Fool.com and is written by David Schneider.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.