There is a lot to like about the long-term prospects for spice and seasoning company McCormick & Company, Incorporated (NYSE:MKC). Consumers are demanding ever more flavor in their cooking, and food companies are being forced to innovate by using flavorings in order to compete in difficult end markets. With these positive trends in place, the company is doing well. But what of its near-term prospects? Moreover, is the stock good value right now?

McCormick delivers mixed results

It was an underwhelming set of second-quarter (Q2) results for McCormick, as reported sales rose a paltry 2%. Its top line growth has been slowing in recent quarters as it laps some difficult comparables. In addition, Yum! Brands, Inc. (NYSE:YUM), is one of its major clients and it’s having some well documented difficulties in China with its KFC stores. First it was a scare over its chicken suppliers, and now it has to deal with fears over bird flu. The issue is hurting Yum!, and McCormick’s industrial sales are being hit because it supplies spices and seasonings to KFC.

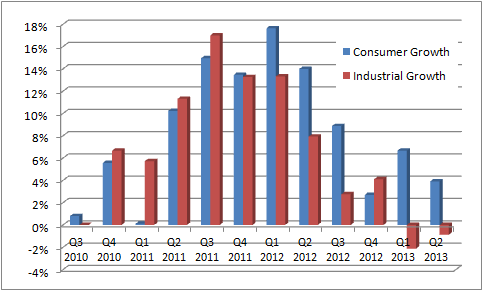

I’ve broken out the progression of McCormick’s divisional sales growth below.

The problems in the industrial division aren’t just about quick-service restaurants in China, because McCormick’s industrial sales in the Americas declined 1%. McCormick & Company, Incorporated (NYSE:MKC) cited strength in its snack seasonings and food flavorings, but it wasn’t enough to offset declines in demand from quick service restaurants in the Americas. The eating out category has faced some weaker growth and, the areas that are growing within it are not favoring McCormick.

All of which is not to be too negative on the stock because it’s the consumer side that makes the majority of profits. And it is still doing quite well.

A breakout of Q2 operating income here.

Consumer segment sales grew 5% in constant currency. Within developed markets, McCormick is benefiting from a increased willingness among consumers to eat at home and, to utilize more flavors in their cooking. The latter trend is also being driven by an increasingly ethnically diverse population in many developed countries.

Within emerging markets, McCormick & Company, Incorporated (NYSE:MKC) is seeing good results via a mix of organic and acquisition-led growth. For example, in India its acquisition of spice company Kohinoor is giving McCormick long-term opportunities in an important growth market. India makes up less that 5% of sales, so there is plenty of scale for this figure to increase in future years. Similarly, the WAPC acquisition in China is believed to bring its Chinese sales up to 7% of the company total.