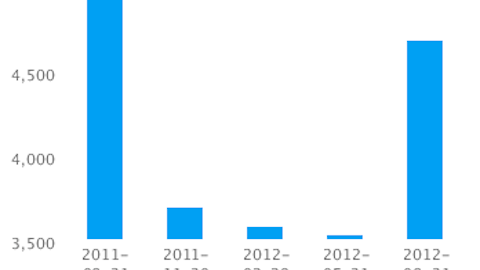

RevPAR across the various business segments jumped from between the high fours to just under 10%. This means the company is raising rates and having no trouble booking the more expensive rooms.

It’s rather clear by now that Marriott has been doing very well navigating the uncertain global macroeconomic environment — especially in an extremely sensitive industry. But what about the future?

Guidance

Marriott management is expecting RevPAR growth to be between 4% and 7% for 2013. From the look of things, and judging by what management focused on during the conference call, the numbers will likely be higher in the range. The 4% reflects the company’s uncertainty regarding the U.S. sequestration issue. Sorenson went as far as to mention during an interview on CNBC Wednesday that the sequester “will not be good for our business.” Now, I don’t want to sell short the ineptitude of our government, but judging by the last few major economic deadlines, Congress should be able to pull a rabbit out of the hat at the 11th hour and kick the can down the road for the billionth time. Therefore, I do not expect too much disruption in Marriott’s business.

Worldwide, Marriott is planning on opening between 30,000 and 35,000 new rooms — half of which will be in the United States. This bodes well for the company (barring sequestration) going forward, given the increases in RevPAR and improving environments.

Valuation

Marriott has already had a strong rise in stock price over the last 12 months, but can it go higher? On a trailing basis, P/E is very rich at 25 times earnings. Forward earnings aren’t cheap either at 16.5. The company is very well run and, as mentioned, destined to grow. Its EV/EBITDA is 11.29 on trailing-12-month EBITDA. For comparison, Host Hotels and Resorts Inc (NYSE:HST) trades at 13.4 times forward earnings and has an EV/EBITDA of 16.27. Chief competitor Hyatt Hotels Corporation (NYSE:H) is much more expensive at 37.94 times forward earnings but with an EV/EBITDA of just 13.95. The company’s price-to-sales is 1.72 versus Marriott’s 4.86.

Marriott’s valuation seems to be average to a bit richer than its competitors’. Hyatt looks more attractive on a sales basis, and the company put out a strong earnings release recently. In my opinion, however, all of these companies are trading a bit rich for my taste and investors should wait for a dip if they want to own a piece of these businesses.

The article Marriott Continues to Dominate, but Valuation Is Rich originally appeared on Fool.com and is written by Michael B. Lewis.

Fool contributor Michael B. Lewis has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.