The market has been volatile due to elections and the potential of another Federal Reserve rate increase. Small cap stocks have been on a tear, as the Russell 2000 ETF (IWM) has outperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of June. SEC filings and hedge fund investor letters indicate that the smart money seems to be getting back in stocks, and the funds’ movements is one of the reasons why small-cap stocks are red hot. In this article, we analyze what the smart money thinks of Dollar General Corp. (NYSE:DG) and find out how it is affected by hedge funds’ moves.

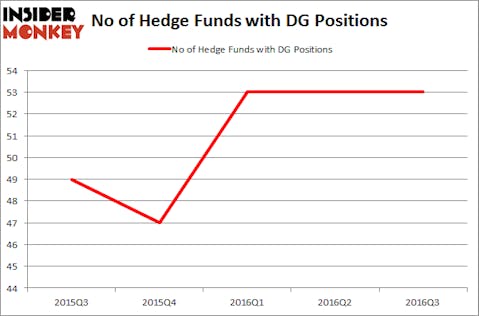

Dollar General Corp. (NYSE:DG) shares haven’t seen a lot of action during the fourth quarter. Overall, hedge fund sentiment was unchanged. The stock was in 53 hedge funds’ portfolios at the end of September. At the end of this article we will also compare DG to other stocks including Fresenius Medical Care AG & Co. (ADR) (NYSE:FMS), Vale SA (ADR) (NYSE:VALE), and General Growth Properties Inc (NYSE:GGP) to get a better sense of its popularity.

Follow Dollar General Corp (NYSE:DG)

Follow Dollar General Corp (NYSE:DG)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: nicoletaionescu / 123RF Stock Photo

Keeping this in mind, we’re going to take a peek at the fresh action surrounding Dollar General Corp. (NYSE:DG).

Hedge fund activity in Dollar General Corp. (NYSE:DG)

Heading into the fourth quarter of 2016, a total of 53 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged for the second straight quarter. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, William B. Gray’s Orbis Investment Management has the largest position in Dollar General Corp. (NYSE:DG), worth close to $199.5 million, amounting to 1.4% of its total 13F portfolio. On Orbis Investment Management’s heels is Lee Ainslie of Maverick Capital, with a $186.3 million position; the fund has 2.2% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions consist of John Overdeck and David Siegel’s Two Sigma Advisors, Ric Dillon’s Diamond Hill Capital and Jeff Lignelli’s Incline Global Management.

Seeing as Dollar General Corp. (NYSE:DG) has witnessed flat sentiment from the entirety of the hedge funds we track, logic holds that there was also a sect of fund managers that elected to cut their full holdings in the third quarter. Intriguingly, Gregory Thomas’ Carbonado Capital dropped the largest investment of all the hedgies tracked by Insider Monkey, totaling close to $28.2 million in stock, and James Dondero’s Highland Capital Management was right behind this move, as the fund sold off about $27.7 million worth of shares. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Dollar General Corp. (NYSE:DG) but similarly valued. These stocks are Fresenius Medical Care AG & Co. (ADR) (NYSE:FMS), Vale SA (ADR) (NYSE:VALE), General Growth Properties Inc (NYSE:GGP), and The Allstate Corporation (NYSE:ALL). This group of stocks’ market valuations are similar to DG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FMS | 6 | 7036 | -1 |

| VALE | 27 | 287513 | 3 |

| GGP | 27 | 306552 | 7 |

| ALL | 27 | 1109142 | -2 |

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $428 million. That figure was $1.17 billion in DG’s case. Vale SA (ADR) (NYSE:VALE) is the most popular stock in this table. On the other hand Fresenius Medical Care AG & Co. (ADR) (NYSE:FMS) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Dollar General Corp. (NYSE:DG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None