This double pressure from the U.S. and Chinese markets has put Las Vegas Sands Corp. (NYSE:LVS), the largest casino company in the world by market cap, in a tough spot. The stock, which has risen more than 2,000% since the dark days of the financial crisis, recently dipped under $50 for the first time in four months. Should investors consider picking up some shares of this volatile growth stock while the markets are off balance, or are lower prices coming soon?

A steadily growing industry in a volatile economy

Las Vegas Sands Corp. (NYSE:LVS), which is based in Las Vegas but generates most of its revenue from Asia, is the largest western casino operator in Macau, also known as the “Vegas of China.” For many years, gambling revenue in Macau soared by high double digits annually, and drew Las Vegas Sands’ American rivals, Wynn Resorts, Limited (NASDAQ:WYNN) and MGM Resorts International (NYSE:MGM), to the table as well. Although expectations have steadily declined to more reasonable growth projections, Macau casinos still reported a 13.5% year-on-year increase in gambling revenue in May – in line with analyst forecasts for 12% to 15% growth.

Although Macau’s gambling business is steadily growing, China’s GDP miss last quarter, its disappointing industrial growth numbers and concerns regarding the country’s banks have all heavily weighed on the stock. China’s interbank lending is currently over 13%, and the government has stated that it does not plan to intervene, as America did, to hold down these lending rates. This has led many analysts to speculate that China is hurtling towards a credit crunch that could cripple its economy.

Breaking down Sands by the numbers

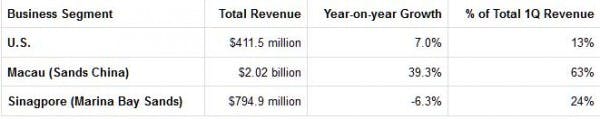

To understand why investors are so worried about Las Vegas Sands Corp. (NYSE:LVS)’s exposure to the Chinese market, we should look back at its first quarter earnings, in which it reported a 13.1% year-on-year increase in profit on a 19.5% gain in revenue.

Source: Las Vegas Sands 1Q Earnings Report

Despite improved numbers in its U.S. properties at Las Vegas and Bethlehem, the company is still completely dependent on the growth of its four Macau properties, especially its flagship Venetian at the Cotai Strip (Macau’s equivalent of the “new” Las Vegas Strip), which generated $872.2 million in revenue, or 43% of its Macau revenue, on its own. Although revenue increased 13% last quarter at the Venetian, revenue slipped 11% at the older Sands Macao casino, which is located in the older part of the city away from the Cotai Strip. However, 39% year-on-year revenue growth is still admirable considering the bearish sentiment regarding China’s economy.

By comparison, Wynn Resorts, Limited (NASDAQ:WYNN) and MGM Resorts International (NYSE:MGM) generate 71% and 30% of their top line from Macau, respectively. Last quarter, Wynn’s earnings rose 52.6% as its revenue rose 5.0%. Its Macau business, which consists of two casino hotels, reported a 4.4% year-on-year gain in revenue. MGM Resorts, which owns a single casino through a 50% joint venture with Macau casino heiress Pansy Ho, squeezed out earnings of a penny per share last quarter, up from a steep loss of $0.44 a year ago, as its revenue rose 3%.

The Foolish Fundamentals

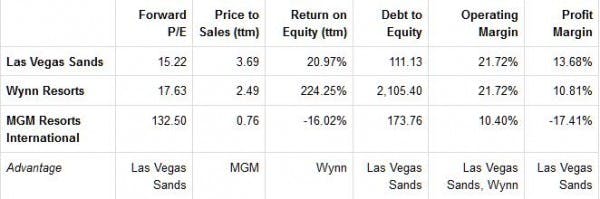

Compared to Wynn and MGM, which both have less exposure to Asia, Las Vegas Sands Corp. (NYSE:LVS) appears to be the better choice fundamentally.

Source: Yahoo Finance, 6/25/2013

Las Vegas Sands Corp. (NYSE:LVS) has the least debt, the best margins, and the cheapest P/E valuation. Its lower debt also insulates it slightly from rising interest rates.