Just in time for the new year, chief U.S. equities strategist at J.P. Morgan Tom Lee appeared on CNBC on December 31st to discuss the firm’s outlook for 2013. Lee and his team are very bullish: he set a fairly high price target for the S&P 500 and recommended cyclical sectors such as basic materials. Interestingly, Lee likes a number of blue chip brands better than lesser known companies in the same industry. In the interview Lee and J.P. Morgan issued ten “best ideas for 2013”; here is our quick take on five of these top picks:

One of J.P. Morgan’s best ideas for 2013 was Apple Inc. (NASDAQ:AAPL) and we agree that this stock is a good value. Apple trades at 12 times trailing earnings and while we aren’t quite as optimistic as the analyst consensus- the forward P/E multiple is only 9, and the five-year PEG ratio is 0.5- we would expect moderate growth from Apple Inc. (NASDAQ:AAPL) and the stock would easily be undervalued if that turned out to be the case. Apple Inc. (NASDAQ:AAPL) was the most popular stock among hedge funds in the third quarter of the year, according to our database of 13F filings (see the full top ten rankings).

Fellow big bank Bank of America Corp (NYSE:BAC) was another of J.P. Morgan’s stock picks, after having nearly doubled in 2012. In terms of book value, Bank of America does look cheap at a P/B ratio of 0.6 but its earnings multiples don’t look as good as those of other large banks, including JPMorgan Chase & Co. (NYSE:JPM) itself. Specifically, the forward P/E is 12. Bank of America was one of the most popular financial stocks among hedge funds last quarter, but we think there are considerably better buys in the sector including JPMorgan Chase and possibly Citigroup Inc. (NYSE:C) and Wells Fargo & Company (NYSE:WFC) as well.

McDonald’s Corporation (NYSE:MCD), another large cap blue chip brand and the most popular restaurant stock among hedge funds last quarter (find more of hedge funds’ favorite restaurant stocks), carries a trailing P/E of 16 and that’s good enough for Lee and his team to recommend buying. Naturally, McDonald’s is a smart defensive pick with a beta of 0.3 and a dividend yield of 3.5%, so it’s not that dependent on J.P. Morgan’s bullishness on the overall market. We would be a bit concerned that its business was stagnant in the third quarter compared to the same period in 2011.

See which aerospace company and which retailer were among J.P. Morgan’s top picks:

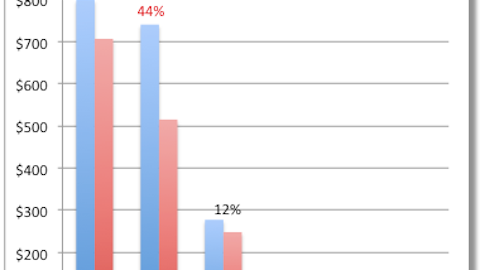

Another pick disclosed in the interview was The Boeing Company (NYSE:BA). Analysts expect that the aerospace and defense company will see declining earnings in 2013, possibly because of cuts in U.S. military spending. In fact, net income was already slipping last quarter, coming in 6% below its levels from Q3 2011 (though revenue was up). Renaissance Technologies, whose success since inception has made founder Jim Simons a billionaire, more than doubled its stake to 1.8 million shares by the end of September (check out Renaissance’s stock picks). At earnings multiples in the teens we think there might be better buys in industrials.

Lee and his team also like Target Corporation (NYSE:TGT). At trailing and forward P/Es of 13 and 12, respectively, the retailer is quite cheap and it hasn’t only staved off online competition but actually had its earnings rise over 10% last quarter versus a year earlier. Note that Target, like McDonalds, has a limited connection to the broader economy and doesn’t depend too much on a bull market. Billionaire Stanley Druckenmiller initiated a position of 1.2 million shares in Target between July and September. We like Target, but it’s possible that other retail stocks are even better buys: Wal-Mart Stores, Inc. (NYSE:WMT) trades at a very small premium to Target, and then there are the dollar stores to consider.