Is Williams Partners L.P. (NYSE:WPZ) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the latest market-moving information.

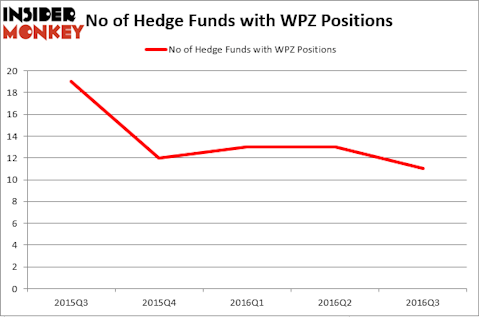

Williams Partners L.P. (NYSE:WPZ) shareholders have witnessed a decrease in activity from the world’s largest hedge funds in recent months. WPZ was in 11 hedge funds’ portfolios at the end of September. There were 13 hedge funds in our database with WPZ positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as AutoZone, Inc. (NYSE:AZO), Canadian Pacific Railway Limited (USA) (NYSE:CP), and Fiserv, Inc. (NASDAQ:FISV) to gather more data points.

Follow Williams Partners L.p. (NYSE:WPZ)

Follow Williams Partners L.p. (NYSE:WPZ)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

chungking/Shutterstock.com

Now, we’re going to analyze the latest action encompassing Williams Partners L.P. (NYSE:WPZ).

What does the smart money think about Williams Partners L.P. (NYSE:WPZ)?

Heading into the fourth quarter of 2016, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a decline of 15% from one quarter earlier. On the other hand, there were a total of 12 hedge funds with a bullish position in WPZ at the beginning of this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, David Tepper’s Appaloosa Management LP has the biggest position in Williams Partners L.P. (NYSE:WPZ), worth close to $344.6 million, amounting to 7.8% of its total 13F portfolio. Sitting at the No. 2 spot is Columbus Hill Capital Management, led by Kevin D. Eng, holding a $70.1 million position; 7.4% of its 13F portfolio is allocated to the stock. Some other professional money managers with similar optimism include Leon Cooperman’s Omega Advisors, James Dondero’s Highland Capital Management and Richard Driehaus’ Driehaus Capital. We should note that Columbus Hill Capital Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Due to the fact that Williams Partners L.P. (NYSE:WPZ) has encountered a bearish sentiment from the aggregate hedge fund industry, logic holds that there were a few money managers who were dropping their full holdings in the third quarter. It’s worth mentioning that Yen Liow’s Aravt Global dropped the largest stake of the “upper crust” of funds monitored by Insider Monkey, totaling about $49.4 million in stock, and Jim Simons’ Renaissance Technologies was right behind this move, as the fund dumped about $2.7 million worth of shares.

Let’s go over hedge fund activity in other stocks similar to Williams Partners L.P. (NYSE:WPZ). We will take a look at AutoZone, Inc. (NYSE:AZO), Canadian Pacific Railway Limited (USA) (NYSE:CP), Fiserv, Inc. (NASDAQ:FISV), and ICICI Bank Limited (ADR) (NYSE:IBN). This group of stocks’ market caps are closest to WPZ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AZO | 39 | 1299064 | -2 |

| CP | 32 | 2233116 | 1 |

| FISV | 27 | 365694 | 1 |

| IBN | 22 | 412923 | 2 |

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $1.08 billion. That figure was $478 million in WPZ’s case. AutoZone, Inc. (NYSE:AZO) is the most popular stock in this table. On the other hand ICICI Bank Limited (ADR) (NYSE:IBN) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Williams Partners L.P. (NYSE:WPZ) is even less popular than IBN. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None