The combination of aggressive e-commerce initiatives and its own internal bribery reviews caused Wal-Mart’s first quarter expenses to surge 44.4% year-on-year, or $200 million. Yet from this following chart, we can see that Wal-Mart’s higher expenses, which barely outpace revenue growth, are merely a continuation of a longer-term trend.

A history of bad PR moves

Wal-Mart’s flat growth and rising expenses are nothing to worry about, especially when it regularly generates over $100 billion in quarterly revenues with an operating cash flow of over $25 billion. Yet over the past few years, Wal-Mart’s repeated PR gaffes have damaged the company’s image and credibility more than its slow top and bottom line growth.

In 2011, The Huffington Post exposed Wal-Mart’s dependence on U.S. prison labor. In 2012, the company became ensnared in bribery allegations in Mexico. Then earlier this year, the company allowed panicked internal emails and meeting minutes to be leaked onto the Internet, in which executives posed confidence-shaking questions such as “Where are all the customers? And where’s their money?”

It’s obvious that Wal-Mart needs some positive PR for a change. Last month, a building collapse in Bangladesh killed more than 1,000 workers. This prompted a joint effort from international retailers to invest in significant safety improvements for their facilities. While this would have been a good opportunity for Wal-Mart to join hands with H&M and PVH Corp (NYSE:PVH) (Calvin Klein, Tommy Hilfiger) to garner some positive publicity, Wal-Mart stated that it would conduct its own independent review of its 279 Bangladeshi factories, instead of joining the safety accord.

I believe that Wal-Mart’s lack of PR control indicates that it simply doesn’t have any wiggle room in its profit margins to spare. In other words, it can no longer afford (or simply no longer cares) to play nice with its rivals.

The Foolish Fundamentals

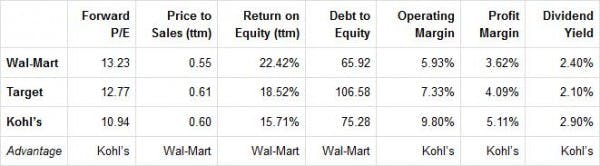

In closing, let’s compare Wal-Mart’s key fundamentals to its primary industry peers.

Source: Yahoo Finance, May 18

Wal-Mart is a fundamentally sound stock, but the question is not if Wal-Mart will fail, but whether if it can succeed. At times, it feels like Wal-Mart’s size is one of its biggest problems. Some larger companies such as Kraft Foods Group Inc (NASDAQ:KRFT), PepsiCo, Inc. (NYSE:PEP), Safeway Inc. (NYSE:SWY) or Philip Morris International Inc. (NYSE:PM) were able to achieve higher profitability by spinning off their contradicting businesses.

Therefore, it may be time for Wal-Mart to consider spinning off its Sam’s Club wholesale business, its international stores, and its e-commerce segment into three separate businesses. These three segments could evolve into different businesses that would attract fresh investor capital.

For now, I believe Wal-Mart is a robust, dependable holding that should post better top and bottom line growth in the second half of the year, after all these weather and PR-related troubles are behind it. Therefore, sunnier days could still be ahead.

The article Is it Time to Buy Wal-Mart? originally appeared on Fool.com and is written by Leo Sun.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.