It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The S&P 500 Index gained 7.6% in the 12 month-period that ended November 21, while less than 49% of its stocks beat the benchmark. In contrast, the 30 most popular mid-cap stocks among the top hedge fund investors tracked by the Insider Monkey team returned 18% over the same period, which provides evidence that these money managers do have great stock picking abilities. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Transocean Partners LLC (NYSE:RIGP).

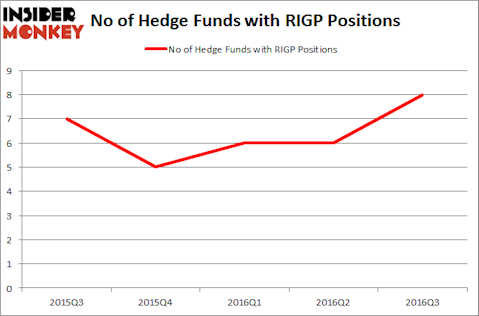

Is Transocean Partners LLC (NYSE:RIGP) an outstanding stock to buy now? Hedge funds are surely getting more optimistic. The number of long hedge fund investments improved by 2 in recent months. There were 8 hedge funds in our database with RIGP positions at the end of September. At the end of this article we will also compare RIGP to other stocks including Insys Therapeutics Inc (NASDAQ:INSY), Fifth Street Finance Corp. (NASDAQ:FSC), and Southside Bancshares, Inc. (NASDAQ:SBSI) to get a better sense of its popularity.

Follow Transocean Partners Llc (NYSE:RIGP)

Follow Transocean Partners Llc (NYSE:RIGP)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Nightman1965/Shutterstock.com

Keeping this in mind, let’s take a glance at the recent action regarding Transocean Partners LLC (NYSE:RIGP).

How have hedgies been trading Transocean Partners LLC (NYSE:RIGP)?

At Q3’s end, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a change of 33% from one quarter earlier. By comparison, 5 hedge funds held shares or bullish call options in RIGP heading into this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Phill Gross and Robert Atchinson’s Adage Capital Management has the most valuable position in Transocean Partners LLC (NYSE:RIGP), worth close to $47.5 million, amounting to 0.1% of its total 13F portfolio. On Adage Capital Management’s heels is Millennium Management, one of the 10 largest hedge funds in the world, holding a $7.3 million position; less than 0.1%% of its 13F portfolio is allocated to the stock. Some other professional money managers with similar optimism encompass Dmitry Balyasny’s Balyasny Asset Management, Ken Griffin’s Citadel Investment Group and Noam Gottesman’s GLG Partners. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

With a general bullishness amongst the heavyweights, specific money managers have been driving this bullishness. GLG Partners, led by Noam Gottesman, initiated the biggest position in Transocean Partners LLC (NYSE:RIGP). GLG Partners had $2.6 million invested in the company at the end of the quarter. John Thiessen’s Vertex One Asset Management also made a $1.1 million investment in the stock during the quarter. The only other fund with a new position in the stock is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s check out hedge fund activity in other stocks similar to Transocean Partners LLC (NYSE:RIGP). We will take a look at Insys Therapeutics Inc (NASDAQ:INSY), Fifth Street Finance Corp. (NASDAQ:FSC), Southside Bancshares, Inc. (NASDAQ:SBSI), and State Bank Financial Corp (NASDAQ:STBZ). This group of stocks’ market caps are closest to RIGP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INSY | 22 | 221640 | 5 |

| FSC | 11 | 15348 | 0 |

| SBSI | 6 | 33580 | 0 |

| STBZ | 12 | 99121 | 0 |

As you can see these stocks had an average of 12.75 hedge funds with bullish positions and the average amount invested in these stocks was $92 million. That figure was $69 million in RIGP’s case. Insys Therapeutics Inc (NASDAQ:INSY) is the most popular stock in this table. On the other hand Southside Bancshares, Inc. (NASDAQ:SBSI) is the least popular one with only 6 bullish hedge fund positions. Transocean Partners LLC (NYSE:RIGP) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard INSY might be a better candidate to consider taking a long position in.

Suggested Articles:

Countries With The Highest Depression Rates

Most Expensive Countries To Buy Cigarettes

Best Karaoke Songs For People Who Can’t Sing

Disclosure: None