Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

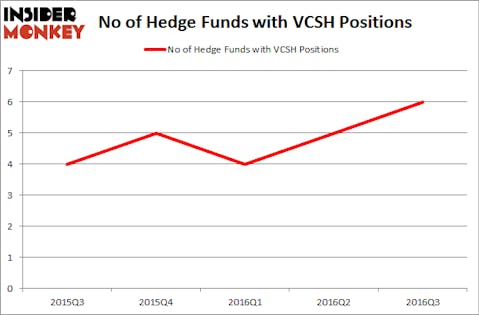

Is the Vanguard Short Term Corporate Bond ETF (NASDAQ:VCSH) an exceptional ETF to buy now? The best stock pickers are definitely in an optimistic mood. The number of bullish hedge fund positions rose by 1 recently. VCSH was in 6 hedge funds’ portfolios at the end of the third quarter of 2016. There were 5 hedge funds in our database with VCSH holdings at the end of the second quarter. At the end of this article we will also compare VCSH to other stocks including Red Hat, Inc. (NYSE:RHT), Mead Johnson Nutrition CO (NYSE:MJN), and Essex Property Trust Inc (NYSE:ESS) to get a better sense of its popularity.

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Horoscope/Shutterstock.com

How have hedgies been trading Vanguard Short Term Corporate Bond ETF (NASDAQ:VCSH)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, up by 20% from the previous quarter, pushing hedge fund ownership of the ETF to a yearly high. The graph below displays the number of hedge funds with bullish positions in VCSH over the last 5 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Bailard Inc, led by Thomas Bailard, holds the largest position in the Vanguard Short Term Corporate Bond ETF (NASDAQ:VCSH). Bailard Inc has an $8 million position in the stock. Sitting at the No. 2 spot is Ken Griffin of Citadel Investment Group, with a $4.6 million position. Some other hedge funds and institutional investors that are bullish encompass Ken Fisher’s Fisher Asset Management, Millennium Management, one of the largest hedge funds in the world, and Murray Stahl’s Horizon Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as the Vanguard Short Term Corporate Bond ETF (NASDAQ:VCSH) but similarly valued. These stocks are Red Hat, Inc. (NYSE:RHT), Mead Johnson Nutrition CO (NYSE:MJN), Essex Property Trust Inc (NYSE:ESS), and Palo Alto Networks Inc (NYSE:PANW). This group of stocks’ market valuations are closest to VCSH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RHT | 34 | 985789 | -1 |

| MJN | 33 | 618764 | 5 |

| ESS | 19 | 359717 | -5 |

| PANW | 35 | 1399417 | -2 |

As you can see these stocks had an average of 30 hedge funds with bullish positions and the average amount invested in these stocks was $841 million. That figure was just $22 million in VCSH’s case. Palo Alto Networks Inc (NYSE:PANW) is the most popular stock in this table. On the other hand Essex Property Trust Inc (NYSE:ESS) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks, the Vanguard Short Term Corporate Bond ETF (NASDAQ:VCSH) is even less popular than ESS. Considering that hedge funds aren’t fond of this ETF in relation to other stocks analyzed in this article, it may be a good idea to study it in detail and understand why the smart money isn’t behind this ETF with much conviction.

Disclosure: None