Rumors and speculation regarding the Apple Inc. (NASDAQ:AAPL) “iWatch” have been less than kind to the concept. According to most articles the iWatch is much ado about nothing.

For example, contributor Hayden Shaughnessay in Forbes, pegs the iWatch concept as a “distraction” that will “drive Apple Inc. (NASDAQ:AAPL)’s shares down.

“The rise of the iWatch has been sudden and dramatic enough to be convincing, almost. On serious reflection, though, this is a big distraction for Apple Inc. (NASDAQ:AAPL) – if, indeed, the watch is going to happen.”

“If it does, it will be seen as a low-value, insignificant project for the world’s greatest tech company, one in fact that a start-up (like Pebble) could have thrown onto a crowdfunding site.”

The author provides a number of arguments that he feels points to the weaknesses in the iWatch concept:

The size of the current watch market is small and fragmented.

Critics will not like the product because it doesn’t “solve complex problems and create complex environments for its products and services.”

Let’s step through these arguments and provide another possible scenario.

Wearables market size

While an iWatch wearable would go on your wrist, using the current watch market as a measure of opportunity is, in my opinion, extremely shortsighted. Telling time, would at best be a tertiary function of the device.

I see the primary purpose of an iWatch to be allowing a user to “keep their iPhone in their pocket” while increasing the availability of valued information. So as an iPhone/smartphone accessory, it seems market size benchmarks are better compared with the current and forecasted smartphone market.

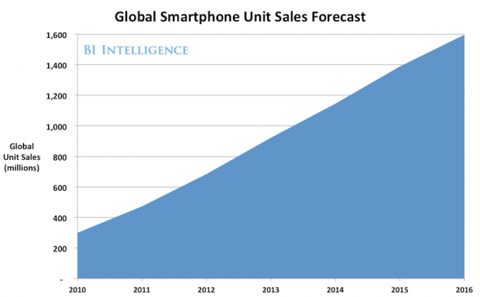

According to estimates current global sales for smartphones stands around 800 million units and are expect to grow to 1.6 billion units by 2016. Assuming 20% penetration for wearables and a (conservative) average price of $199 – the wearable market opportunity ranges from $31.8 – $63.6 billion dollars.

Wearables function: To keep phone and wallet in pocket or purse

Shaughnessy claims, with no big idea behind the iWatch, there will be no investor excitement to drive share price. I argue the opposite – I see an iWatch (or any wearable) as the key product that completes the “mobile computing promise” of smartphones.

By design, a smartphone is often not in a user’s hands. A wearable, tethered to a smartphone, allows for “instant access” to smartphone functions, eliminating the ongoing “phone fumble” that often happens in the car, at a meeting, in the gym, or while simply taking a walk. User value for the device will be driven by increased ubiquity of information.

Here are a few examples of possible high value “instant access” information for users (again, the wearable allows access to the data immediater, with no fishing in pocket or purse.):

Check and reply to incoming phone calls, emails and messages

Get and monitor maps/directions

Query for closest retail (gas stations, restaurants, banks, etc.)

Take pictures and video

Monitor “high interest, frequent look” information including stock prices, social media feeds, sports scores, weather and news headlines.

But, I don’t think that “instant access” is necessarily the big “Big Idea:”

Could the iWatch actually be the iWallet?

There’s been question of why Apple Inc. (NASDAQ:AAPL) has not included near field communication (NFC) payment capability with the iPhone. Perhaps one reason for leaving NFC out is Apple Inc. (NASDAQ:AAPL) believes that smartphones do not provide the ideal payment experience. Watch customers using their iPhone to pay at Starbucks to see a less than ideal solution. (You’ll see people holding phones awkwardly in line, double checking to make sure their phone screen is illuminated, cutting short phone conversations, reply to emails while trying to bounce-back to Passbook, etc.).

Inclusion of NFC (or other payment protocol) into an iWatch would provide for a hands-free payment system for users. With an iWatch on their wrist there is no need to for a customer to reach in their pocket or purse for a wallet, or phone. Apple Inc. (NASDAQ:AAPL)‘s ability to incorporate Authentec (acquired by Apple) fingerprint scan technology – could provide an intuitive, simple, seamless wallet-free, protected payment system that is

poised, at all times at the customer-retailer point of sale.

Not convinced? Don’t forget that Apple Inc. (NASDAQ:AAPL) has in its database over 200 million active credit card accounts making Apple Inc. (NASDAQ:AAPL) one the biggest credit card hubs in retail. Migrating that payment power onto the wrists of one of the most demographically attractive market segments in retail (iPhone owners) would provide Apple Inc. (NASDAQ:AAPL) with an incalculable advantage in the burgeoning wireless payment arena.

Also, keep in mind Google Inc (NASDAQ:GOOG)‘s interest in developing a glasses-based wearable. Creating a wrist-based payment system for the iWatch could provide Apple Inc. (NASDAQ:AAPL) with a significant advantage over the Google system. (Apple Inc. (NASDAQ:AAPL) leads in payments with their vast credit card trove as well as the intuitiveness of a hand-based payment system. I suspect some wearable users would be uncomfortable with a payment system that involved a swipe of their glasses?)

But, will Nike mind?

Based on the ability to position Apple Inc. (NASDAQ:AAPL)’s iWatch as a next generation mobile instant access/wireless payment system, it is difficult to see Nike complaining too vociferously over an Apple Inc. (NASDAQ:AAPL) move into wrist-based computing. More than likely, Nike would see the iWatch as a significant opportunity to expand the Nike-Apple partnership with “Fuelband-like” applications specifically for the iWatch. (The Fuelband targets the serious fitness buff – there is likely a larger market for the more general “health conscious” consumer, who would have an interest in a Nike branded iWatch app.)

iWatch: The revenue potential could be huge

Based on the opportunities that I’ve outlined, I think a wrist-based wearable tethered to an iPhone would provide Apple Inc. (NASDAQ:AAPL) with a market opportunity that could have a material impact on the company’s revenue. (It should be noted, this is a position that some analysts and those in the media disagree with.)

Whether Apple Inc. (NASDAQ:AAPL) recognizes (or is interested in) this type of wearable application remains to be seen. However, given the leaks of an Apple watch-like device hitting the media, it makes sense for Apple Inc. (NASDAQ:AAPL) investors to analyze possible areas for the company to leverage their clear market advantages.

The article Is the iWatch Actually an iWallet? originally appeared on Fool.com and is written by Bill Shambllin.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.