You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

Hedge fund interest in Tenet Healthcare Corp (NYSE:THC) shares was flat during the last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Inovalon Holdings Inc (NASDAQ:INOV), CoreSite Realty Corp (NYSE:COR), and FireEye Inc (NASDAQ:FEYE) to gather more data points.

Follow Tenet Healthcare Corp (NYSE:THC)

Follow Tenet Healthcare Corp (NYSE:THC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

A and N photography/Shutterstock.com

Keeping this in mind, let’s take a gander at the fresh action regarding Tenet Healthcare Corp (NYSE:THC).

How have hedgies been trading Tenet Healthcare Corp (NYSE:THC)?

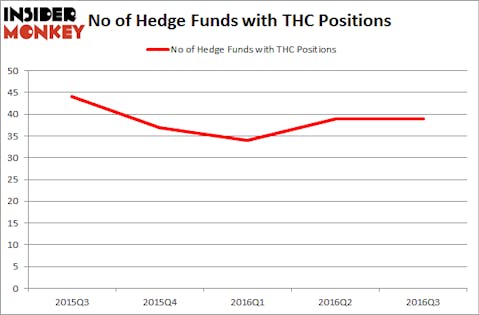

At Q3’s end, a total of 39 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from one quarter earlier. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Larry Robbins’ Glenview Capital has the number one position in Tenet Healthcare Corp (NYSE:THC), worth close to $405.4 million, amounting to 2.9% of its total 13F portfolio. The second largest stake is held by Camber Capital Management, led by Stephen DuBois, holding a $56.7 million position; the fund has 2.5% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors with similar optimism comprise Samuel Isaly’s OrbiMed Advisors, Douglas Braunstein and James Woolery’s Hudson Executive Capital and Ken Griffin’s Citadel Investment Group.

Judging by the fact that Tenet Healthcare Corp (NYSE:THC) has witnessed falling interest from hedge fund managers, logic holds that there is a sect of hedgies who sold off their positions entirely last quarter. Interestingly, Glenn J. Krevlin’s Glenhill Advisors dropped the largest stake of the “upper crust” of funds monitored by Insider Monkey, valued at close to $35.9 million in stock, and Roberto Mignone’s Bridger Management was right behind this move, as the fund dropped about $25 million worth of stock. These bearish behaviors are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to Tenet Healthcare Corp (NYSE:THC). These stocks are Inovalon Holdings Inc (NASDAQ:INOV), CoreSite Realty Corp (NYSE:COR), FireEye Inc (NASDAQ:FEYE), and J.C. Penney Company, Inc. (NYSE:JCP). This group of stocks’ market caps are similar to THC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INOV | 4 | 2747 | -2 |

| COR | 18 | 90393 | 0 |

| FEYE | 29 | 284327 | 2 |

| JCP | 32 | 459927 | 4 |

As you can see these stocks had an average of 20.75 hedge funds with bullish positions and the average amount invested in these stocks was $209 million. That figure was $759 million in THC’s case. J.C. Penney Company, Inc. (NYSE:JCP) is the most popular stock in this table. On the other hand Inovalon Holdings Inc (NASDAQ:INOV) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Tenet Healthcare Corp (NYSE:THC) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio despite the flat ownership likely brought about by sector fears which have since alleviated somewhat.

Disclosure: None