The market has been volatile due to elections and the potential of another Federal Reserve rate increase. Small cap stocks have been on a tear, as the Russell 2000 ETF (IWM) has outperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of June. SEC filings and hedge fund investor letters indicate that the smart money seems to be getting back in stocks, and the funds’ movements is one of the reasons why small-cap stocks are red hot. In this article, we analyze what the smart money thinks of Spectra Energy Corp. (NYSE:SE) and find out how it is affected by hedge funds’ moves.

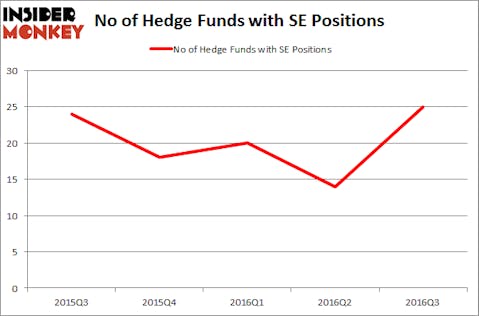

Is Spectra Energy Corp. (NYSE:SE) a buy right now? The smart money is becoming hopeful. The number of bullish hedge fund positions inched up by 11 recently. SE was in 25 hedge funds’ portfolios at the end of the third quarter of 2016. There were 14 hedge funds in our database with SE positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Southwest Airlines Co. (NYSE:LUV), Baxter International Inc. (NYSE:BAX), and China Unicom (Hong Kong) Limited (ADR) (NYSE:CHU) to gather more data points.

Follow Spectra Energy Corp. (NYSE:SE)

Follow Spectra Energy Corp. (NYSE:SE)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Zorandim/Shutterstock.com

Hedge fund activity in Spectra Energy Corp. (NYSE:SE)

At the end of the third quarter, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a massive jump of 79% from one quarter earlier, surging to a yearly high in hedge fund ownership. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Robert Emil Zoellner’s Alpine Associates has the largest position in Spectra Energy Corp. (NYSE:SE), worth close to $141 million and accounting for 5.2% of its total 13F portfolio. The second most bullish fund manager is Magnetar Capital, led by Alec Litowitz and Ross Laser, holding a $107.4 million position; the fund has 1.7% of its 13F portfolio invested in the stock. Other professional money managers that are bullish include Daniel Bubis’ Tetrem Capital Management, Carl Tiedemann and Michael Tiedemann’s TIG Advisors, and Cliff Asness’ AQR Capital Management.

With general bullishness amongst the heavyweights, key hedge funds were breaking ground themselves. Alpine Associates established the most valuable position in Spectra Energy Corp. (NYSE:SE), followed by Magnetar Capital. The other funds with new positions in the stock are TIG Advisors, John Overdeck and David Siegel’s Two Sigma Advisors, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s now take a look at hedge fund activity in other stocks similar to Spectra Energy Corp. (NYSE:SE). These stocks are Southwest Airlines Co. (NYSE:LUV), Baxter International Inc. (NYSE:BAX), China Unicom (Hong Kong) Limited (ADR) (NYSE:CHU), and CSX Corporation (NYSE:CSX). This group of stocks’ market valuations are closest to SE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LUV | 53 | 2290720 | 8 |

| BAX | 50 | 4345509 | -4 |

| CHU | 12 | 39176 | 5 |

| CSX | 43 | 734912 | 2 |

As you can see these stocks had an average of 40 hedge funds with bullish positions and the average amount invested in these stocks was $1.85 billion. That figure was just $446 million in SE’s case. Southwest Airlines Co. (NYSE:LUV) is the most popular stock in this table. On the other hand China Unicom (Hong Kong) Limited (ADR) (NYSE:CHU) is the least popular one with only 12 bullish hedge fund positions. Spectra Energy Corp. (NYSE:SE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard LUV might be a better candidate to consider a long position in.

Disclosure: None