Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Pressmaster/Shutterstock.com

How are hedge funds trading Santander Mexico Fincl Gp SAB deCV (ADR) (NYSE:BSMX)?

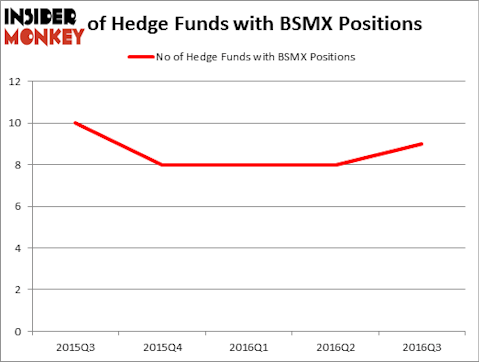

At Q3’s end, a total of 9 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 13% rise from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards BSMX over the last 5 quarters, which was flat during the first-half of the year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Noam Gottesman of GLG Partners holds the number one position in Santander Mexico Fincl Gp SAB deCV (ADR) (NYSE:BSMX). GLG Partners has a $9 million call position in the stock. The second largest stake is held by John W. Rogers of Ariel Investments, which has a $4.4 million position. Other professional money managers with similar optimism encompass Cliff Asness’ AQR Capital Management and Renaissance Technologies, one of the largest hedge funds in the world. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

As one would reasonably expect, key money managers were leading the bulls’ herd. GLG Partners initiated the most outsized call position in Santander Mexico Fincl Gp SAB deCV (ADR) (NYSE:BSMX). Jacob Rothschild’s RIT Capital Partners also initiated a $1.3 million position during the quarter. The following funds were also among the new BSMX investors: Israel Englander’s Millennium Management and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Santander Mexico Fincl Gp SAB deCV (ADR) (NYSE:BSMX) but similarly valued. These stocks are Silver Wheaton Corp. (USA) (NYSE:SLW), Global Payments Inc (NYSE:GPN), Quest Diagnostics Inc (NYSE:DGX), and CMS Energy Corporation (NYSE:CMS). This group of stocks’ market valuations match BSMX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SLW | 27 | 507942 | -2 |

| GPN | 20 | 436064 | -10 |

| DGX | 24 | 349248 | -1 |

| CMS | 19 | 395362 | 1 |

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $422 million. That figure was $25 million in BSMX’s case. Silver Wheaton Corp. (USA) (NYSE:SLW) is the most popular stock in this table. On the other hand CMS Energy Corporation (NYSE:CMS) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks Santander Mexico Fincl Gp SAB deCV (ADR) (NYSE:BSMX) is even less popular than CMS. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock.

Disclosure: None