Is Sanofi SA (ADR) (NYSE:SNY) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from industry insiders. They fail miserably sometimes but historically their consensus stock picks outperformed the market after adjusting for known risk factors.

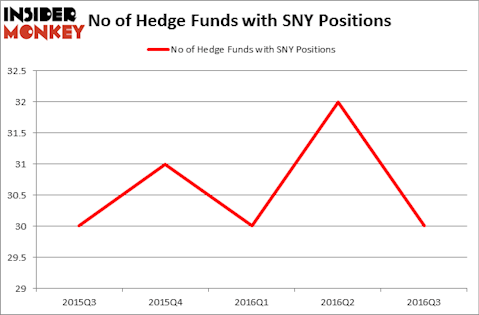

Sanofi SA (ADR) (NYSE:SNY) has seen a decrease in hedge fund interest of late. SNY was in 30 hedge funds’ portfolios at the end of September, down from 32 funds a quarter earlier. At the end of this article we will also compare SNY to other stocks including Kraft Heinz Co (NASDAQ:KHC), NTT Docomo Inc (ADR) (NYSE:DCM), and 3M Co (NYSE:MMM) to get a better sense of its popularity.

Follow Sanofi Aventis (NASDAQ:SNY)

Follow Sanofi Aventis (NASDAQ:SNY)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

wavebreakmedia/Shutterstock.com

Keeping this in mind, we’re going to take a gander at the recent action encompassing Sanofi SA (ADR) (NYSE:SNY).

What have hedge funds been doing with Sanofi SA (ADR) (NYSE:SNY)?

At the end of the third quarter, a total of 30 of the hedge funds tracked by Insider Monkey were bullish on this stock, down by 6% from one quarter earlier. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Fisher Asset Management, led by Ken Fisher, holds the biggest position in Sanofi SA (ADR) (NYSE:SNY). Fisher Asset Management has a $475.2 million stake in the company. Sitting at the No. 2 spot is Warren Buffett’s Berkshire Hathaway, with a $149.2 million position. Remaining members of the smart money that are bullish include John Paulson’s Paulson & Co, Francis Chou’s Chou Associates Management, and Malcolm Fairbairn’s Ascend Capital.

Judging by the fact that Sanofi SA (ADR) (NYSE:SNY) has experienced declining sentiment from the entirety of the hedge funds we track, it’s easy to see that there exists a select few hedge funds that slashed their positions entirely during the third quarter. Interestingly, Steven Boyd’s Armistice Capital cut the biggest position of the 700 funds tracked by Insider Monkey, comprising about $5.8 million in stock, and Paul Cantor, Joseph Weiss, and Will Wurm’s Beech Hill Partners was right behind this move, as the fund dropped about $3.5 million worth of shares.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Sanofi SA (ADR) (NYSE:SNY) but similarly valued. We will take a look at Kraft Heinz Co (NASDAQ:KHC), NTT Docomo Inc (ADR) (NYSE:DCM), 3M Co (NYSE:MMM), and McDonald’s Corporation (NYSE:MCD). All of these stocks’ market caps match SNY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KHC | 52 | 31239057 | -8 |

| DCM | 6 | 91843 | -2 |

| MMM | 40 | 539304 | 3 |

| MCD | 55 | 2771731 | -8 |

As you can see these stocks had an average of 38 hedge funds with bullish positions and the average amount invested in these stocks was $8.66 billion. That figure was $716 million in SNY’s case. McDonald’s Corporation (NYSE:MCD) is the most popular stock in this table. On the other hand NTT Docomo Inc (ADR) (NYSE:DCM) is the least popular one with only six bullish hedge fund positions. Sanofi SA (ADR) (NYSE:SNY) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MCD might be a better candidate to consider a long position.

Disclosure: None