Hedge funds are not perfect. They have their bad picks just like everyone else. Valeant, a stock hedge funds have loved, lost 79% during the last 12 months ending in November 21. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 mid-cap stocks among the best performing hedge funds yielded an average return of 18% in the same time period, vs. a gain of 7.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the successful funds think of Royal Bank of Scotland Group plc (ADR) (NYSE:RBS) .

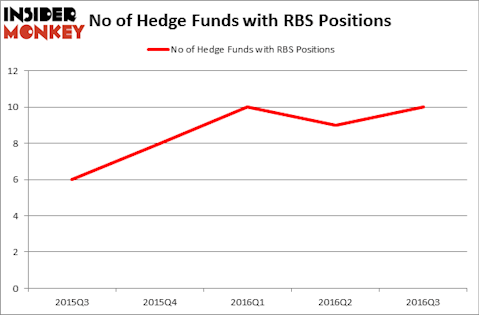

Royal Bank of Scotland Group plc (ADR) (NYSE:RBS) was in 10 hedge funds’ portfolios at the end of September. RBS investors should pay attention to an increase in hedge fund interest lately. There were 9 hedge funds in our database with RBS holdings at the end of the previous quarter. At the end of this article we will also compare RBS to other stocks including Credit Suisse Group AG (ADR) (NYSE:CS), SYSCO Corporation (NYSE:SYY), and Chunghwa Telecom Co., Ltd (ADR) (NYSE:CHT) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Fer Gregory/Shutterstock.com

With all of this in mind, we’re going to view the recent action encompassing Royal Bank of Scotland Group plc (ADR) (NYSE:RBS).

Hedge fund activity in Royal Bank of Scotland Group plc (ADR) (NYSE:RBS)

Heading into the fourth quarter of 2016, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 11% from the previous quarter. On the other hand, there were a total of 8 hedge funds with a bullish position in RBS at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Eric Halet and Davide Serra of Algebris Investments holds the most valuable position in Royal Bank of Scotland Group plc (ADR) (NYSE:RBS). Algebris Investments has a $9.6 million position in the stock, comprising 1.7% of its 13F portfolio. Sitting at the No. 2 spot is Matthew Knauer and Mina Faltas of Nokota Management which holds a $2.9 million position. Other professional money managers that hold long positions comprise Jim Simons’ Renaissance Technologies, one of the largest hedge funds in the world. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.