There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other successful funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Precision Drilling Corp (USA) (NYSE:PDS).

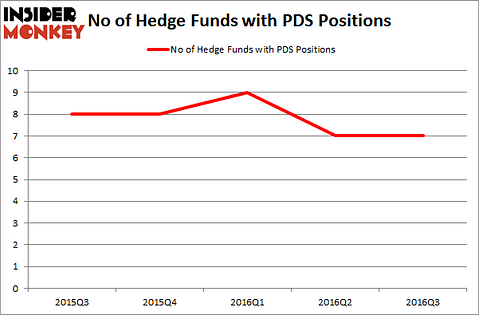

Precision Drilling Corp (USA) (NYSE:PDS) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 7 hedge funds’ portfolios at the end of the third quarter of 2016. At the end of this article we will also compare PDS to other stocks including Aerojet Rocketdyne Holdings Inc (NYSE:AJRD), Supernus Pharmaceuticals Inc (NASDAQ:SUPN), and Benchmark Electronics, Inc. (NYSE:BHE) to get a better sense of its popularity.

Follow Precision Drilling Corp (NYSE:PDS)

Follow Precision Drilling Corp (NYSE:PDS)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

QiuJu Song/Shuterrstock.com

Now, let’s view the fresh action encompassing Precision Drilling Corp (USA) (NYSE:PDS).

How are hedge funds trading Precision Drilling Corp (USA) (NYSE:PDS)?

At Q3’s end, a total of 7 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards PDS over the last 5 quarters. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s database, Tetrem Capital Management has the largest position in Precision Drilling Corp (USA) (NYSE:PDS), worth close to $28 million, accounting for 1.1% of its total 13F portfolio. On Tetrem Capital Management’s heels is Millennium Management, one of the 10 largest hedge funds in the world, which holds a $9.1 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other peers that are bullish contain Vince Maddi and Shawn Brennan’s SIR Capital Management, John Thiessen’s Vertex One Asset Management and David Costen Haley’s HBK Investments. We should note that SIR Capital Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Seeing as Precision Drilling Corp (USA) (NYSE:PDS) has experienced falling interest from the entirety of the hedge funds we track, it’s easy to see that there is a sect of hedgies that decided to sell off their positions entirely heading into Q4. Interestingly, John Overdeck and David Siegel’s Two Sigma Advisors cashed in the biggest stake of all the investors followed by Insider Monkey, valued at about $0.5 million in stock, and Matthew Hulsizer’s PEAK6 Capital Management was right behind this move, as the fund dropped about $0.1 million worth of shares.

Let’s now review hedge fund activity in other stocks similar to Precision Drilling Corp (USA) (NYSE:PDS). We will take a look at Aerojet Rocketdyne Holdings Inc (NYSE:AJRD), Supernus Pharmaceuticals Inc (NASDAQ:SUPN), Benchmark Electronics, Inc. (NYSE:BHE), and Sears Holdings Corporation (NASDAQ:SHLD). This group of stocks’ market caps are closest to PDS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AJRD | 14 | 271637 | -2 |

| SUPN | 20 | 51198 | 2 |

| BHE | 17 | 157165 | 1 |

| SHLD | 15 | 768632 | -1 |

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $312 million. That figure was $46 million in PDS’s case. Supernus Pharmaceuticals Inc (NASDAQ:SUPN) is the most popular stock in this table. On the other hand Aerojet Rocketdyne Holdings Inc (NYSE:AJRD) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Precision Drilling Corp (USA) (NYSE:PDS) is even less popular than AJRD. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.