Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track more than 700 prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile gigantic failures like hedge funds’ recent losses in Valeant. Let’s take a closer look at what the funds we track think about PepsiCo, Inc. (NYSE:PEP) in this article.

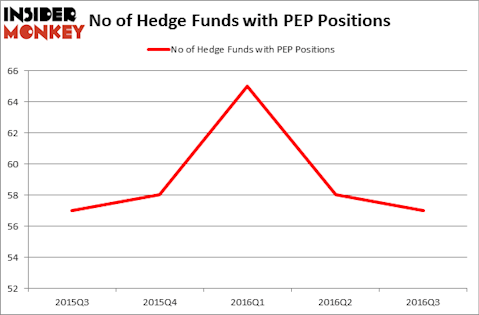

When it comes to PepsiCo, Inc. (NYSE:PEP), it seems like hedge funds are in a bearish mood, as the number of long hedge fund bets fell by one in recent months. At the end of this article we will also compare PEP to other stocks including International Business Machines Corp. (NYSE:IBM), Unilever plc (ADR) (NYSE:UL), and Cisco Systems, Inc. (NASDAQ:CSCO) to get a better sense of its popularity.

Follow Pepsico Inc (NASDAQ:PEP)

Follow Pepsico Inc (NASDAQ:PEP)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

MAHATHIR MOHD YASIN / Shutterstock.com

Now, we’re going to view the new action encompassing PepsiCo, Inc. (NYSE:PEP).

Hedge fund activity in PepsiCo, Inc. (NYSE:PEP)

At the end of September, 57 funds tracked by Insider Monkey were long PepsiCo, down by 2% from one quarter earlier. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Donald Yacktman’s Yacktman Asset Management has the largest position in PepsiCo, Inc. (NYSE:PEP), worth close to $957.4 million, comprising 8.3% of its total 13F portfolio. Coming in second is Boykin Curry’s Eagle Capital Management, with a $824.8 million position; the fund has 3.6% of its 13F portfolio invested in the stock. Remaining peers with similar optimism encompass Ken Fisher’s Fisher Asset Management, Cliff Asness’ AQR Capital Management, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.