Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Pebblebrook Hotel Trust (NYSE:PEB).

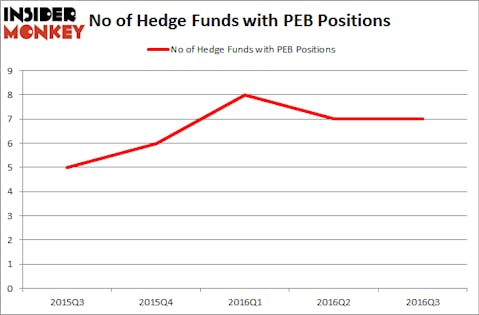

Pebblebrook Hotel Trust (NYSE:PEB) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 7 hedge funds’ portfolios at the end of the third quarter of 2016. At the end of this article we will also compare PEB to other stocks including Texas Pacific Land Trust (NYSE:TPL), MicroStrategy Incorporated (NASDAQ:MSTR), and Deckers Outdoor Corp (NASDAQ:DECK) to get a better sense of its popularity.

Follow Pebblebrook Hotel Trust (NYSE:PEB)

Follow Pebblebrook Hotel Trust (NYSE:PEB)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Now, we’re going to take a look at the latest action encompassing Pebblebrook Hotel Trust (NYSE:PEB).

How are hedge funds trading Pebblebrook Hotel Trust (NYSE:PEB)?

At Q3’s end, a total of 7 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged from the previous quarter. On the other hand, there were a total of 6 hedge funds with a bullish position in PEB at the beginning of this year. With hedgies’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Greg Poole’s Echo Street Capital Management has the most valuable position in Pebblebrook Hotel Trust (NYSE:PEB), worth close to $5.9 million, amounting to 0.2% of its total 13F portfolio. Sitting at the No. 2 spot is Clinton Group, led by George Hall, which holds a $2.6 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions encompass Millennium Management, one of the 10 largest hedge funds in the world, Cliff Asness’s AQR Capital Management and Brad Dunkley and Blair Levinsky’s Waratah Capital Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Seeing as Pebblebrook Hotel Trust (NYSE:PEB) has faced no change in sentiment from the aggregate hedge fund industry, we must look if there are any funds that sold off their positions entirely by the end of the third quarter. Interestingly, J. Alan Reid, Jr.’s Forward Management dropped the largest investment of the “upper crust” of funds tracked by Insider Monkey, valued at close to $24.6 million in stock. Ken Griffin’s fund, Citadel Investment Group, also dropped its stock, about $4 million worth of PEB shares.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Pebblebrook Hotel Trust (NYSE:PEB) but similarly valued. These stocks are Texas Pacific Land Trust (NYSE:TPL), MicroStrategy Incorporated (NASDAQ:MSTR), Deckers Outdoor Corp (NASDAQ:DECK), and Fortress Investment Group LLC (NYSE:FIG). This group of stocks’ market values match PEB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TPL | 7 | 444207 | 7 |

| MSTR | 23 | 306704 | -3 |

| DECK | 17 | 240981 | 2 |

| FIG | 21 | 100036 | -2 |

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $273 million. That figure was $14 million in PEB’s case. MicroStrategy Incorporated (NASDAQ:MSTR) is the most popular stock in this table. On the other hand Texas Pacific Land Trust (NYSE:TPL) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Pebblebrook Hotel Trust (NYSE:PEB) is even less popular than TPL. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: none.