Before we spend many hours researching a company, we’d like to analyze what hedge funds and billionaire investors think of the stock first. We would like to do so because the successful investors’ consensus returns have been exceptional. The top 30 mid-cap stocks among the best performing hedge funds in our database yielded an average return of 18% during the last 12 months, outperforming the S&P 500 Index funds by double digits. Although the successful funds occasionally have their duds, such as SunEdison and Valeant, the hedge fund picks seem to work on average. In the following paragraphs, we find out what the billionaire investors and hedge funds think of NTT Docomo Inc (ADR) (NYSE:DCM).

Is NTT Docomo Inc (ADR) (NYSE:DCM) the right pick for your portfolio? Prominent investors don’t feel so, as they are definitely reducing their bets on the stock. The number of long hedge fund positions went down by 2 recently. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as CVS Caremark Corporation (NYSE:CVS), Nippon Telegraph & Telephone Corp (ADR) (NYSE:NTT), and BHP Billiton Limited (ADR) (NYSE:BHP) to gather more data points.

Follow N T T Docomo Inc (NYSE:DCM)

Follow N T T Docomo Inc (NYSE:DCM)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

How are hedge funds trading NTT Docomo Inc (ADR) (NYSE:DCM)?

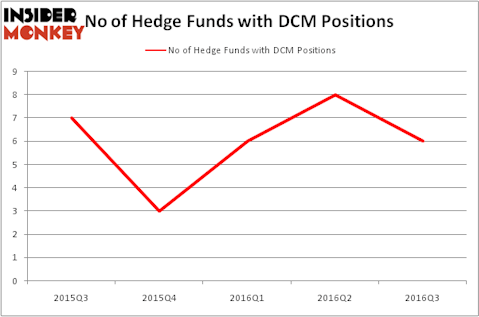

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 25% drop from one quarter earlier. By comparison, 3 hedge funds held shares or bullish call options in DCM heading into this year, so hedge fund sentiment is still positive in 2016. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Renaissance Technologies, one of the largest hedge funds in the world, has the biggest position in NTT Docomo Inc (ADR) (NYSE:DCM), worth close to $68.8 million. The second largest stake is held by Arrowstreet Capital, led by Peter Rathjens, Bruce Clarke and John Campbell, which owns a $14.1 million position. Remaining members of the smart money with similar optimism consist of Israel Englander’s Millennium Management, David E. Shaw’s D E Shaw, and Matthew Tewksbury’s Stevens Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

Since NTT Docomo Inc (ADR) (NYSE:DCM) has faced a decline in interest from hedge fund managers, logic holds that there was a specific group of hedgies who sold off their positions entirely by the end of the third quarter. Interestingly, Louis Navellier’s Navellier & Associates got rid of the largest investment of all the investors followed by Insider Monkey, comprising about $0.3 million in stock, and Joel Greenblatt’s Gotham Asset Management was right behind this move, as the fund cut about $0.2 million worth of shares.

Let’s go over hedge fund activity in other stocks similar to NTT Docomo Inc (ADR) (NYSE:DCM). We will take a look at CVS Caremark Corporation (NYSE:CVS), Nippon Telegraph & Telephone Corp (ADR) (NYSE:NTT), BHP Billiton Limited (ADR) (NYSE:BHP), and Royal Bank of Canada (USA) (NYSE:RY). All of these stocks’ market caps are similar to DCM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CVS | 58 | 2005455 | 4 |

| NTT | 10 | 182797 | -1 |

| BHP | 19 | 253041 | 2 |

| RY | 17 | 455517 | 0 |

As you can see these stocks had an average of 26 hedge funds with bullish positions and the average amount invested in these stocks was $724 million. That figure was $92 million in DCM’s case. CVS Caremark Corporation (NYSE:CVS) is the most popular stock in this table. On the other hand Nippon Telegraph & Telephone Corp (ADR) (NYSE:NTT) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks NTT Docomo Inc (ADR) (NYSE:DCM) is even less popular than NTT. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock.

Disclosure: None