Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

Nordic American Tanker Ltd (NYSE:NAT) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 13 hedge funds’ portfolios at the end of September, same as at the end of June. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Monotype Imaging Holdings Inc. (NASDAQ:TYPE), Associated Capital Group Inc (NYSE:AC), and Biglari Holdings Inc (NYSE:BH) to gather more data points.

Follow Nordic American Tankers Limited (NYSE:NAT)

Follow Nordic American Tankers Limited (NYSE:NAT)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Inozemtsev Konstantin/Shutterstock.com

How are hedge funds trading Nordic American Tanker Ltd (NYSE:NAT)?

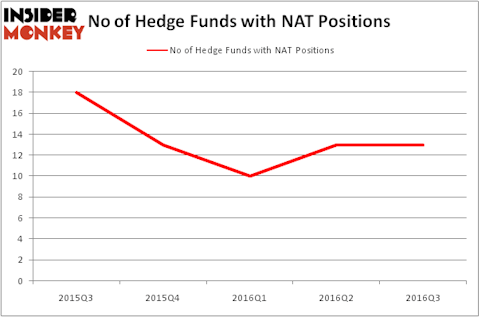

Heading into the fourth quarter of 2016, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards NAT over the last 5 quarters, which has trended downwards overall, so is up by 30% over the past 2 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Laurion Capital Management, led by Benjamin A. Smith, holds the largest position in Nordic American Tanker Ltd (NYSE:NAT). Laurion Capital Management has a $30.3 million position in the stock. Sitting at the No. 2 spot is Marshall Wace LLP, led by Paul Marshall and Ian Wace, holding a $13.2 million position. Remaining members of the smart money with similar optimism encompass Israel Englander’s Millennium Management, Daniel Gold’s QVT Financial, and Robert Vollero and Gentry T. Beach’s Vollero Beach Capital Partners. We should note that Vollero Beach Capital Partners is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at some funds that dropped their entire stakes in the stock during the third quarter. It’s worth mentioning that Joel Greenblatt’s Gotham Asset Management dropped the largest stake of all the investors studied by Insider Monkey, totaling about $4 million in stock, and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund dropped about $0.9 million worth of shares.

Let’s check out hedge fund activity in other stocks similar to Nordic American Tanker Ltd (NYSE:NAT). We will take a look at Monotype Imaging Holdings Inc. (NASDAQ:TYPE), Associated Capital Group Inc (NYSE:AC), Biglari Holdings Inc (NYSE:BH), and First Commonwealth Financial (NYSE:FCF). All of these stocks’ market caps are similar to NAT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TYPE | 20 | 95672 | 3 |

| AC | 4 | 25656 | 1 |

| BH | 5 | 40413 | -1 |

| FCF | 5 | 12624 | 1 |

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $44 million. That figure was $68 million in NAT’s case. Monotype Imaging Holdings Inc. (NASDAQ:TYPE) is the most popular stock in this table. On the other hand Associated Capital Group Inc (NYSE:AC) is the least popular one with only 4 bullish hedge fund positions. Nordic American Tanker Ltd (NYSE:NAT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard TYPE might be a better candidate to consider taking a long position in.

Disclosure: None