The rise of new-age Internet service technology, spurring the development of Internet TV, can certainly eat into the Internet service and cable service revenues of Comcast.

Rise of Internet TV: Intel Corporation (INTC) is coming up with its new Internet TV set-top device, as per this article.

“Intel’s set-top box will deliver a better viewing experience than traditional cable and satellite companies, as well as Web-connected devices from Apple, Roku, and other manufacturers, Huggers said.”

Although the high programming license fees, the lack of time-relevant premium content, and the low speed of broadband Internet have been straining on the growth of Internet TV, things are changing with Gigabit Squared and Google Fiber. That shows in the current Nielson study as follows:

“Traditional TV distribution-such as broadcast or cable-and watching on a TV set continues to be the dominant means of ingesting video content. Much like eReaders, which saw small but noticeable gains in penetration in the last three quarters of 2011, but have since made nice strides and has Q1 2012 penetration at 21 percent, IPTV seems to be following suit and market penetration is on the rise. As of February 2012, 10.4 percent of homes had an IPTV, compared to just 4.7 percent that same month a year prior, according to a recent Nielsen study.”

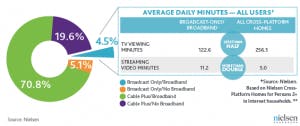

According to a new report from Nielsen, the number of U.S. homes that have broadband Internet, but only free, broadcast TV, is on the rise. Although representing less than 5% of TV households, the number has grown 22.8% over the past year. As the cable charges are forecasted to go up in the coming years, this number will go up as well.

And we all know that it means bad news for the cable companies. Is Comcast sufficiently preparing for that?

Increased programming costs: The multichannel video provider industry has continued to experience an increase in the cost of programming, especially sports programming. Programming costs are the costs that each TV distributor pays to the cable networks. And with rising programming expenses, the cost of a subscription goes up. Consequently, more and more people look for cheaper alternatives.

For example, starting in Feb 2013, DirecTV subscriber prices will go up by 4.5% to offset rising programming costs. This isn’t something new. In fact, the satellite company increased its pricing by a similar percentage in both 2011 and 2012 as well.

Unfortunately, this spells bad news for Comcast from both sides, since it owns cable networks as well. With either must-carry status or retransmission consent, Comcast may have to play according to market rules. It is noteworthy though that all of the NBC and Telemundo owned local television stations have elected retransmission consent for the period January 1, 2012 through December 31, 2014. Yet, these agreements are subject to change after that period, which might affect Comcast’s bottom-line.