This week, Comcast Corporation (NASDAQ:CMCSA) announced that it would buy the rest of NBC Universal from General Electric Company (NYSE:GE), as was agreed upon in 2009.The question is whether this deal is an optimum investment for Comcast at the moment. Are there any risk factors that need to be looked into? Is Comcast’s business strategy in the right place?

In December 2009, Comcast announced that it was buying control of NBC Universal from GE at a price of $30 billion. In 2011, Comcast provided nearly $14 billion in assets, including $6.5 billion in cash, for 51% ownership of the new entity. The rest of the money was to be paid within 8 years. Fast forward to the present, and Comcast is paying an approximate amount of $16.7 billion to acquire the remaining 49% of GE’s ownership in NBC Universal.

“This is an exciting day for Comcast as we have agreed to accelerate the purchase of NBC Universal. The management team at GE has been a wonderful partner during the past two years and their support has been very valuable. Our decision to acquire GE’s ownership is driven by our sense of optimism for the future prospects of NBC Universal and our desire to capture future value that we hope to create for our shareholders […] We believe the terms of the transaction are attractive and have planned for this event by taking a number of financial steps to prepare our balance sheet. We believe we are in a strong and unique position to continue to grow and build value in our combined company.”

Although this is a huge move by Comcast in the media and entertainment industry, the company might be facing problems in the near future if it doesn’t focus on a few factors, as detailed below.

A few factors that bother me

Less focus on Internet broadband service: While Verizon Communications Inc. (NYSE:VZ) and AT&T Inc. (NYSE:T) are focusing hard on their wireless broadband service, Comcast is buying channels, buildings and broadcasting stations. Is lack of wireless broadband services a detriment in Comcast’s business? Probably, it is, as per the excerpt below (from the annual report:)

“In certain of our service areas in 2012, some of our phone company competitors, including Verizon, have their own wireless facilities, which we do not have, and have expanded or may expand their cable service offerings to include bundled wireless offerings, which may adversely affect our business and results of operations.”

Now, with the advent of new-age Internet service providing technology, will Comcast have a problem holding on to its Internet users?

Take for instance, Google Inc (NASDAQ:GOOG) Fiber. Recently rolled out by Google Inc (NASDAQ:GOOG), it offers up to one-gigabit upload & download speed with full TV channel lineup with no data caps, one Nexus 7 tablet, one storage box, one network box and a 1TB Google Drive at a nominal cost of $120 per month plus taxes and fees. Compare that to the Comcast’s Extreme 105 plan that offers 105 Mbps Internet speed at $199.95 per month, or even 300-500 Kbps wireless Internet speed at a range of $40-60 per month.

The rise of new-age Internet service technology, spurring the development of Internet TV, can certainly eat into the Internet service and cable service revenues of Comcast.

Rise of Internet TV: Intel Corporation (INTC) is coming up with its new Internet TV set-top device, as per this article.

“Intel’s set-top box will deliver a better viewing experience than traditional cable and satellite companies, as well as Web-connected devices from Apple, Roku, and other manufacturers, Huggers said.”

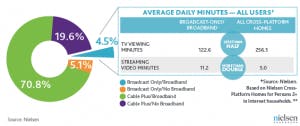

Although the high programming license fees, the lack of time-relevant premium content, and the low speed of broadband Internet have been straining on the growth of Internet TV, things are changing with Gigabit Squared and Google Fiber. That shows in the current Nielson study as follows:

“Traditional TV distribution-such as broadcast or cable-and watching on a TV set continues to be the dominant means of ingesting video content. Much like eReaders, which saw small but noticeable gains in penetration in the last three quarters of 2011, but have since made nice strides and has Q1 2012 penetration at 21 percent, IPTV seems to be following suit and market penetration is on the rise. As of February 2012, 10.4 percent of homes had an IPTV, compared to just 4.7 percent that same month a year prior, according to a recent Nielsen study.”

According to a new report from Nielsen, the number of U.S. homes that have broadband Internet, but only free, broadcast TV, is on the rise. Although representing less than 5% of TV households, the number has grown 22.8% over the past year. As the cable charges are forecasted to go up in the coming years, this number will go up as well.

And we all know that it means bad news for the cable companies. Is Comcast sufficiently preparing for that?

Increased programming costs: The multichannel video provider industry has continued to experience an increase in the cost of programming, especially sports programming. Programming costs are the costs that each TV distributor pays to the cable networks. And with rising programming expenses, the cost of a subscription goes up. Consequently, more and more people look for cheaper alternatives.

For example, starting in Feb 2013, DirecTV subscriber prices will go up by 4.5% to offset rising programming costs. This isn’t something new. In fact, the satellite company increased its pricing by a similar percentage in both 2011 and 2012 as well.

Unfortunately, this spells bad news for Comcast from both sides, since it owns cable networks as well. With either must-carry status or retransmission consent, Comcast may have to play according to market rules. It is noteworthy though that all of the NBC and Telemundo owned local television stations have elected retransmission consent for the period January 1, 2012 through December 31, 2014. Yet, these agreements are subject to change after that period, which might affect Comcast’s bottom-line.

Federal support to Internet networking: There have been stringent conditions on which this NBC Universal deal has been sanctioned.

1). Comcast is supposed to relinquish its rights to Hulu.

2). Programming cannot not be withheld from any sort of legal competitor.

3). Equal agreement terms for all parties, with respect to the market.

From the company report:

“As a result of the NBC Universal transaction, we are subject to the NBC Universal Order and the NBC Universal Consent Decree, which have imposed numerous conditions on our businesses relating to the treatment of competitors and other matters. Failure to comply with the laws and regulations applicable to our businesses could result in administrative enforcement actions, fines and civil and criminal liability.”

Transaction payment terms: The transactions are to be funded with $11.4 billion in cash, $4 billion of subsidiary senior unsecured notes to be issued to GE, $2 billion of borrowings under Comcast and/or subsidiary bank credit facilities and $725 million of subsidiary preferred stock to be issued to GE.

With $11 billion of cash on hand as of 31 December 2012, high debt-to-equity ratio of 78.9 and current ratio of 1, the acquisition will tighten Comcast’s working capital budget. Comcast will have to perform under pressure and only revenue growth can sustain the company’s future stock performance.

Bottom line

While the deal certainly has a lot of importance for Comcast, it is wise to think about the latest technological changes and their effects on the business model. With tight working capital, unsteady market consumption preferences, and new-age technological breakthroughs, things might get tougher for Comcast, and that will be bad for Comcast shareholders.

Comcast needs to look into these factors in the coming few quarters, and that might help you make a decision on Comcast as an investment. Having said that, Comcast is a big name in the IT, media and entertainment industries, and will always have a lot of traction downward. So holding the stock for a few quarters ahead is the right thing to do at the time.

The article Is NBC Universal An Optimum Investment For Comcast? originally appeared on Fool.com and is written by Suman Chatterjee.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.