Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

Is Macy’s Inc (NYSE:M) the right pick for your portfolio? Prominent investors are unambiguously betting on the stock. The number of long hedge fund positions advanced by 6 recently. Mwas in 63 hedge funds’ portfolios at the end of September. There were 57 hedge funds in our database with M holdings at the end of the previous quarter. At the end of this article we will also compare M to other stocks including Oneok Partners LP (NYSE:OKS), Harris Corporation (NYSE:HRS), and International Flavors & Fragrances Inc (NYSE:IFF) to get a better sense of its popularity.

Follow Macy's Inc. (NYSE:M)

Follow Macy's Inc. (NYSE:M)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

With all of this in mind, let’s view the recent action encompassing Macy’s Inc (NYSE:M).

How have hedgies been trading Macy’s Inc (NYSE:M)?

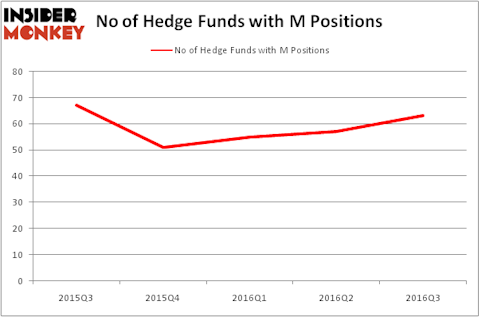

Heading into the fourth quarter of 2016, a total of 63 of the hedge funds tracked by Insider Monkey were bullish on this stock, up 11% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in M over the last 5 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Israel Englander’s Millennium Management has the biggest position in Macy’s Inc (NYSE:M), worth close to $118.2 million, corresponding to 0.2% of its total 13F portfolio. Sitting at the No. 2 spot is Starboard Value LP, led by Jeffrey Smith, holding a $111.5 million position; the fund has 3% of its 13F portfolio invested in the stock. Some other professional money managers that are bullish consist of Rob Citrone’s Discovery Capital Management, Cliff Asness’s AQR Capital Management and Clint Carlson’s Carlson Capital. We should note that Starboard Value LP is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As industrywide interest jumped, some big names have been driving this bullishness. Discovery Capital Management, led by Rob Citrone, assembled the biggest position in Macy’s Inc (NYSE:M). According to regulatory filings, the fund had $94.3 million invested in the company at the end of the quarter. Josh Resnick’s Jericho Capital Asset Management also made a $38.7 million investment in the stock during the quarter. The other funds with new positions in the stock are Mike Masters’s Masters Capital Management, Gregory Thomas’s Carbonado Capital, and Solomon Kumin’s Folger Hill Asset Management.

Let’s now review hedge fund activity in other stocks similar to Macy’s Inc (NYSE:M). We will take a look at Oneok Partners LP (NYSE:OKS), Harris Corporation (NYSE:HRS), International Flavors & Fragrances Inc (NYSE:IFF), and Martin Marietta Materials, Inc. (NYSE:MLM). This group of stocks’ market caps match M’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OKS | 9 | 33692 | 2 |

| HRS | 22 | 476297 | 1 |

| IFF | 16 | 269994 | -4 |

| MLM | 35 | 1223233 | -2 |

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $501 million. That figure was an impressive $1.34 billion in M’s case. Martin Marietta Materials, Inc. (NYSE:MLM) is the most popular stock in this table. On the other hand Oneok Partners LP (NYSE:OKS) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Macy’s Inc (NYSE:M) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: none.