The market has been volatile due to elections and the potential of another Federal Reserve rate increase. Small cap stocks have been on a tear, as the Russell 2000 ETF (IWM) has outperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of June. SEC filings and hedge fund investor letters indicate that the smart money seems to be getting back in stocks, and the funds’ movements is one of the reasons why small-cap stocks are red hot. In this article, we analyze what the smart money thinks of Lincoln National Corporation (NYSE:LNC) and find out how it is affected by hedge funds’ moves.

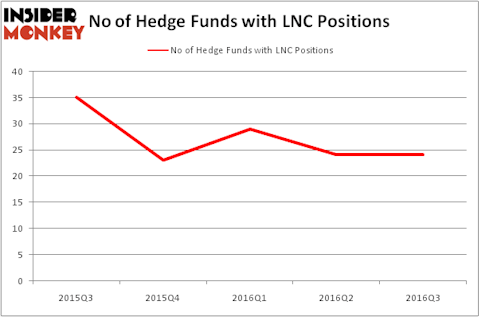

Lincoln National Corporation (NYSE:LNC) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 24 hedge funds’ portfolios at the end of the third quarter of 2016. At the end of this article we will also compare LNC to other stocks including Wynn Resorts, Limited (NASDAQ:WYNN), Duke Realty Corp (NYSE:DRE), and Snap-on Incorporated (NYSE:SNA) to get a better sense of its popularity.

Follow Lincoln National Corp (NYSE:LNC)

Follow Lincoln National Corp (NYSE:LNC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Tashatuvango/Shutterstock.com

How have hedgies been trading Lincoln National Corporation (NYSE:LNC)?

At the end of the third quarter, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from one quarter earlier, and still well off the stock’s hedge fund ownership level a year earlier. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, East Side Capital (RR Partners), managed by Steven Richman, holds the most valuable position in Lincoln National Corporation (NYSE:LNC). East Side Capital (RR Partners) has a $161.3 million position in the stock, comprising 7.8% of its 13F portfolio. Coming in second is AQR Capital Management, managed by Cliff Asness, which holds a $137 million position. Other hedge funds and institutional investors that are bullish contain Ken Griffin’s Citadel Investment Group, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Israel Englander’s Millennium Management.

Since Lincoln National Corporation (NYSE:LNC) has witnessed declining sentiment from the entirety of the hedge funds we track, logic holds that there was a specific group of fund managers that slashed their full holdings last quarter. Interestingly, Ray Dalio’s Bridgewater Associates dumped the largest stake of the 700 funds monitored by Insider Monkey, worth about $10.9 million in call options. Citadel Investment Group also sold off its call options, about $3.2 million worth, while still holding a long position. These transactions are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Lincoln National Corporation (NYSE:LNC) but similarly valued. We will take a look at Wynn Resorts, Limited (NASDAQ:WYNN), Duke Realty Corp (NYSE:DRE), Snap-on Incorporated (NYSE:SNA), and Vereit Inc (NYSE:VER). All of these stocks’ market caps are closest to LNC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WYNN | 38 | 2245380 | 8 |

| DRE | 11 | 44166 | 1 |

| SNA | 27 | 651564 | -1 |

| VER | 27 | 664382 | -2 |

As you can see these stocks had an average of 25.75 hedge funds with bullish positions and the average amount invested in these stocks was $901 million. That figure was $668 million in LNC’s case. Wynn Resorts, Limited (NASDAQ:WYNN) is the most popular stock in this table. On the other hand Duke Realty Corp (NYSE:DRE) is the least popular one with only 11 bullish hedge fund positions. Lincoln National Corporation (NYSE:LNC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard WYNN might be a better candidate to consider a long position.

Disclosure: None