The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Kansas City Southern (NYSE:KSU) .

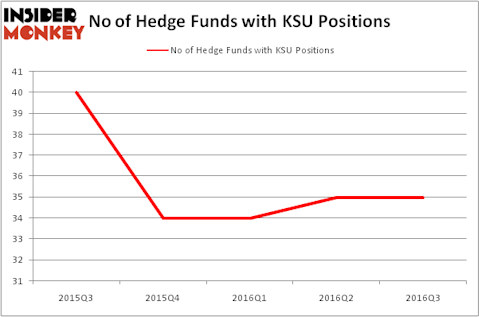

Kansas City Southern (NYSE:KSU) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 35 hedge funds’ portfolios at the end of the third quarter of 2016. At the end of this article we will also compare KSU to other stocks including Restaurant Brands International Inc (NYSE:QSR), LKQ Corporation (NASDAQ:LKQ), and Discovery Communications Inc. (NASDAQ:DISCK) to get a better sense of its popularity.

Follow Kansas City Southern (NYSE:KSU)

Follow Kansas City Southern (NYSE:KSU)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

IM_photo/Shutterstock.com

Now, we’re going to take a look at the latest action encompassing Kansas City Southern (NYSE:KSU).

Hedge fund activity in Kansas City Southern (NYSE:KSU)

At Q3’s end, a total of 35 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in KSU over the last 5 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Stockbridge Partners, led by Sharlyn C. Heslam, holds the biggest position in Kansas City Southern (NYSE:KSU). Stockbridge Partners has a $106.1 million position in the stock, comprising 5.1% of its 13F portfolio. Coming in second is Jonathon Jacobson of Highfields Capital Management, with a $104.5 million position; 1% of its 13F portfolio is allocated to the company. Some other professional money managers that are bullish contain Israel Englander’s Millennium Management, Anand Parekh’s Alyeska Investment Group and Ken Fisher’s Fisher Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at some funds that dumped their entire stakes in the stock during the third quarter. Intriguingly, Keith Meister’s Corvex Capital dumped the biggest stake of all the investors monitored by Insider Monkey, worth close to $55.4 million in stock. Alexander Mitchell’s fund, Scopus Asset Management, also sold off its stock, about $29.7 million worth.

Let’s go over hedge fund activity in other stocks similar to Kansas City Southern (NYSE:KSU). These stocks are Restaurant Brands International Inc (NYSE:QSR), LKQ Corporation (NASDAQ:LKQ), Discovery Communications Inc. (NASDAQ:DISCK), and Celanese Corporation (NYSE:CE). All of these stocks’ market caps are similar to KSU’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| QSR | 32 | 3143758 | 1 |

| LKQ | 32 | 668630 | 2 |

| DISCK | 21 | 280090 | -3 |

| CE | 31 | 817436 | -2 |

As you can see these stocks had an average of 29 hedge funds with bullish positions and the average amount invested in these stocks was $1227 million. That figure was $907 million in KSU’s case. Restaurant Brands International Inc (NYSE:QSR) is the most popular stock in this table. On the other hand Discovery Communications Inc. (NASDAQ:DISCK) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks Kansas City Southern (NYSE:KSU) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Suggested Articles:

Countries With The Highest High School Graduation Rates

Most Profitable Franchises Under $50K

Easiest Countries To Gain Citizenship In EU

Disclosure: None