Monster Beverage Corp (NASDAQ:MNST) is down almost 25% so far this week on speculation that five people may have died over the last three years after drinking Monster’s energy drinks. The FDA’s reports show no proven link between Monster and the deaths. On top of the report that was brought public by the mother of a 14-year-old girl who died last year after drinking Monster’s energy drinks, the mother has also filed a lawsuit against the energy beverage company.

Earlier this month the investment firm Stifel Nicolaus downgraded Monster, with analyst Mark Astrachan citing a potential greater than expected sales slowdown. Nicolaus placed a $59 price target on the company, compared to the current trading price of $43. More recently, Goldman Sachs removed Monster from its ‘conviction buy’ list this week, but maintained a buy on the company.

Key beverage competitors of Monster includes The Coca-Cola Company (NYSE:KO), PepsiCo, Inc. (NYSE:PEP), and Dr Pepper Snapple Group Inc. (NYSE:DPS). Coca-Cola, maker of the Full Throttle energy drink, recently saw reaffirmation from S&P on the company’s buy rating. Coca-Cola grew sales by 32% in 2011, but is expected to only grow volumes in the mid-single digits for the next few years. Coca-Cola also posted 3Q EPS that missed consensus by $0.01—see our earnings analysis. However, S&P maintains its $44 price target, versus the current $36.70 stock price.

Pepsi is the maker of AMP energy drinks and bottler of Rockstar energy drinks. Pepsi’s initiative to continue to grow internationally, with the acquisition of Wimm-Bill-Dann, should help offset concerns in the America beverage industry, but overall sales are still expected to slip 1% in 2012. Pepsi has been a trendsetter in focusing on health and wellness and plans to spend $500 million in 2012 to better market its brands in North America—see if Pepsi is a buy. Both Coca-Cola and Pepsi pay dividends yielding around 3% and are the giants in the beverage industry, but both are expected to see 5-year annual EPS growth come in less than 8%.

Dr. Pepper is the third largest beverage maker in North America, but has more exposure to commodity prices and may see margin compression should oil prices remain elevated. Non-carbonated beverages are expected to outpace carbonated beverages over the near term, which is bad news for Dr. Pepper, as the company has a less robust portfolio of non-carbonated beverages. Dr Pepper does trade the lowest on a P/E basis of the major beverage companies and saw notable fund interest in 2Q from Ken Griffin who was the top fund owner of shares by far with 3.5 million shares. Bill Miller also took interest in the company and took a new position of almost 500,000.

Kraft Foods Group, Inc. (NASDAQ:KRFT) entered the energy drink market last year with its MiO drink. Kraft vowed not to market to anyone under eighteen years old, yet the fact that a snack food company is entering the energy market is positive for the industry. Even with regulatory pressure, Kraft felt that energy drinks were too big to ignore, where the company estimates that the market as a whole generates around $6 billion in annual sales. MiO generated around $100 million in revenue during its first year.

We believe the energy drink market has room to grow, making up only around 3% of the carbonated drink market by volume. Monster should continue to be an industry leader, and the recent selloff in its stock price should provide a buying opportunity. Red Bull and Monster, per Nielsen Co., dominated the energy drink market share earlier this year, with Red Bull owning 37% of the market and Monster 35%. Monster called Jim Simons and Steven Cohen as its top two fund owners in 2Q, with over 2 million shares each, and also saw tiger cub Patrick McCormack with 3.4% of his firm’s 2Q 13F portfolio invested in the energy drink maker—see why hedge funds love Monster.

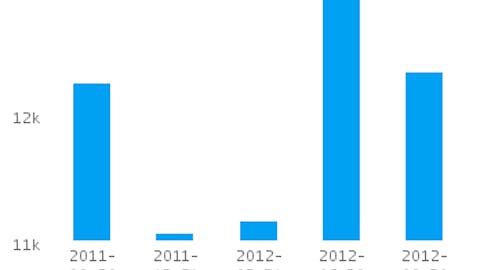

Monster is expected to see another 25% increase in 2012, with the key sales driver being international growth. During 2Q, Monster launched in Ecuador and Japan, and plans to launch in Singapore and Chile in late 2012. The big overhang for the shares will be the potential for adverse regulatory actions related to the sale or marketing of energy drinks. Yet, the company has the best growth prospects, with an expected five-year EPS annual growth rate of 15%, and it trades at a forward P/E of 17.5x, which is below its historical forward P/E of 21x.