Insider trading has been a profitable investment strategy in the United States for more than 50 years. In a previous article, we pointed to a study showing the profitability of insider trading in the Netherlands. Showing that insider trading is profitable in several other countries gives more credibility to our claim that it’s profitable here. Insiders certainly have more valuable information about their companies than do most (if not all) other investors. The fundamental question is do they take advantage of their private information by profitably trading in the stock market. Perhaps outsiders could profitably monkey these transactions and achieve excess returns.

Germany has a very short history regarding insider transactions. Until 1994, it wasn’t even illegal for insiders to trade based on material, non-public information. Until July 2002, insiders (and their family members) didn’t have to report their transactions to the public. So the few studies that analyze insider trading returns in Germany that do exist are quite recent.

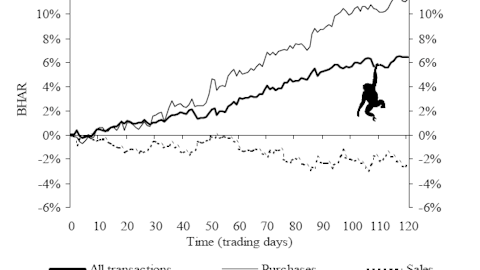

One study shows that insiders in Germany profit substantially by trading in their companies’ stocks. During the first 20 trading days after their transactions, the stocks insiders bought achieved a cumulative abnormal return of 4.38% and the stocks insiders sold declined by 1.47%. These numbers are even better than what we observe in the United States. Another interesting finding is that corporate officers (CEO, CFO, etc.) rarely traded and didn’t earn abnormal returns, whereas members of the board of directors and other insiders traded frequently and often right before major announcements. They achieved higher abnormal returns. One explanation for this is German prosecutors don’t tolerate trading by officers but turn a blind eye to other insiders.

German insiders have 5 business days to report their transactions to the public. Assuming that they wait till the end of this 5 day window, the returns during these five days won’t be available to outsiders (the authors also report that the median reporting delay is only 3 days). Fortunately, during the first 5 days cumulative abnormal return to insider purchases is only 1.62%. Considering that the 20-day cumulative abnormal return is 4.38%, outsiders who mimic insider buys could still achieve a 2.76% return in 15 trading days. These are amazing returns. This shows that markets are very slow to reacting to insider transactions.

It IS possible to beat index funds by monkeying insider purchases.

Related Articles:

Recent Academic Studies in US

Unbelievable Insider Trading Returns in Italy