At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

In this article, we are going to take a closer look at the latest hedge fund activity surrounding Eros International plc (NYSE:EROS). Overall, the company registered an increase in popularity among the funds in our database during the third quarter. There were eight hedge funds in our database with EROS positions at the end of September. At the end of this article we will also compare EROS to other stocks including Noble Midstream Partners LP (NYSE:NBLX), Heartland Financial USA Inc (NASDAQ:HTLF), and Universal Insurance Holdings, Inc. (NYSEAMEX:UVE) to get a better sense of its popularity.

Follow Eros Stx Global Corporation (NYSE:ESGC)

Follow Eros Stx Global Corporation (NYSE:ESGC)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

With all of this in mind, we’re going to take a glance at the key action regarding Eros International plc (NYSE:EROS).

How have hedgies been trading Eros International plc (NYSE:EROS)?

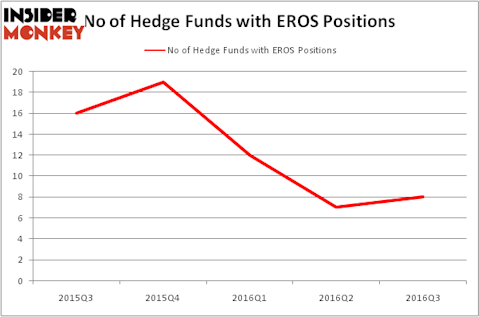

At Q3’s end, eight funds tracked by Insider Monkey were bullish on this stock, which represents an increase of 14% from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in EROS over the last five quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Gifford Combs’ Dalton Investments has the number one position in Eros International plc (NYSE:EROS), worth close to $27 million, amounting to 10.9% of its total 13F portfolio. On Dalton Investments’s heels is David Forster and Peter Wilton’s IBIS Capital Partners, with a $11.6 million position; the fund has 4.3% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors with similar optimism consist of Principal Global Investors’s Columbus Circle Investors, Neil Chriss’ Hutchin Hill Capital and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.