You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

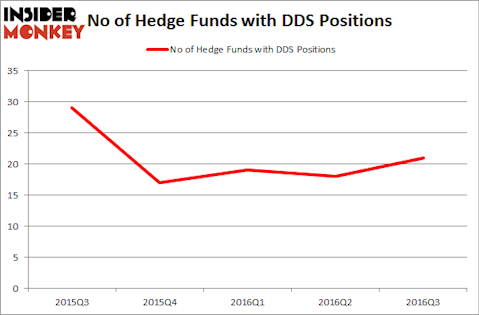

Dillard’s, Inc. (NYSE:DDS) investors should pay attention to an increase in support from the world’s most successful money managers lately. DDS was in 21 hedge funds’ portfolios at the end of September. There were 18 hedge funds in our database with DDS holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Nomad Foods Limited Ordinary Shares (NYSE:NOMD), Interval Leisure Group, Inc. (NASDAQ:IILG), and Press Ganey Holdings Inc (NYSE:PGND) to gather more data points.

Follow Dillard's Inc. (NYSE:DDS)

Follow Dillard's Inc. (NYSE:DDS)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Nejron Photo/Shutterstock.com

What have hedge funds been doing with Dillard’s, Inc. (NYSE:DDS)?

At Q3’s end, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a rise of 17% from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards DDS over the last 5 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Greenlight Capital, led by David Einhorn, holds the most valuable position in Dillard’s, Inc. (NYSE:DDS). Greenlight Capital has a $121.7 million position in the stock, comprising 2.3% of its 13F portfolio. Sitting at the No. 2 spot is AQR Capital Management, led by Cliff Asness, holding a $33 million position. Some other peers with similar optimism include Chuck Royce’s Royce & Associates, Joel Greenblatt’s Gotham Asset Management and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.