Insider Monkey finished processing more than 700 13F filings made by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of September 30. In this article we are going to take a look at smart money sentiment towards DexCom, Inc. (NASDAQ:DXCM).

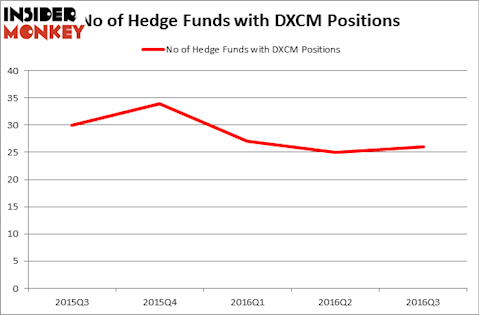

DexCom, Inc. (NASDAQ:DXCM) shareholders have witnessed an increase in hedge fund sentiment recently. DXCM was in 26 hedge funds’ portfolios at the end of the third quarter of 2016. There were 25 hedge funds in our database with DXCM positions at the end of the previous quarter. At the end of this article we will also compare DXCM to other stocks including New Oriental Education & Tech Grp (ADR) (NYSE:EDU), Hyatt Hotels Corporation (NYSE:H), and FactSet Research Systems Inc. (NYSE:FDS) to get a better sense of its popularity.

Follow Dexcom Inc (NASDAQ:DXCM)

Follow Dexcom Inc (NASDAQ:DXCM)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Syda Productions/Shutterstock.com

What does the smart money think about DexCom, Inc. (NASDAQ:DXCM)?

At the end of the third quarter, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a rise of 4% from the second quarter of 2016, though hedge fund ownership remains well beneath its level of 9 months earlier. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Columbus Circle Investors, managed by Principal Global Investors, holds the number one position in DexCom, Inc. (NASDAQ:DXCM). Columbus Circle Investors has a $124.5 million position in the stock, comprising 1.3% of its 13F portfolio. On Columbus Circle Investors’ heels is Bridger Management, managed by Roberto Mignone, which holds a $47.2 million position; 3.2% of its 13F portfolio is allocated to the company. Some other professional money managers with similar optimism comprise Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management, Steve Cohen’s Point72 Asset Management, and Joseph Edelman’s Perceptive Advisors.

Consequently, key hedge funds have jumped into DexCom, Inc. (NASDAQ:DXCM) headfirst. LMR Partners, managed by Ben Levine, Andrew Manuel and Stefan Renold, created the biggest position in DexCom, Inc. (NASDAQ:DXCM). LMR Partners had $6.9 million invested in the company at the end of the quarter. Noam Gottesman’s GLG Partners also made a $2.8 million investment in the stock during the quarter. The other funds with brand new DXCM positions are Matthew Tewksbury’s Stevens Capital Management, Simon Sadler’s Segantii Capital, and Ken Griffin’s Citadel Investment Group.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as DexCom, Inc. (NASDAQ:DXCM) but similarly valued. These stocks are New Oriental Education & Tech Grp (ADR) (NYSE:EDU), Hyatt Hotels Corporation (NYSE:H), FactSet Research Systems Inc. (NYSE:FDS), and Nordstrom, Inc. (NYSE:JWN). This group of stocks’ market valuations match DXCM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EDU | 20 | 288666 | 0 |

| H | 23 | 293258 | 5 |

| FDS | 16 | 280411 | 1 |

| JWN | 30 | 282280 | 4 |

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $286 million. That figure was $300 million in DXCM’s case. Nordstrom, Inc. (NYSE:JWN) is the most popular stock in this table. On the other hand FactSet Research Systems Inc. (NYSE:FDS) is the least popular one with only 16 bullish hedge fund positions. DexCom, Inc. (NASDAQ:DXCM) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard JWN might be a better candidate to consider a long position in.

Disclosure: None